Charly van Dijk, Senior Community and Economic Development Advisor, Atlanta Fed

Top photo: Charly at the grand opening of the Enterprising Latina’s Wimauma Opportunity Center in Hillsborough County, Florida, July 2022.

Small-business ownership, financial services access, and women’s economic issues are common themes in Charlene “Charly” van Dijk’s life and career. “In graduate school [at the Georgetown School of Foreign Service], I took a class about international microlending, or financial services that target individuals who lack traditional financial resources, and loved it,” she said. “I felt connected to the promise that access to capital held for women entrepreneurs.” After graduation, Charly worked for an institution in the Washington DC metro area that specialized in small loans for women- and minority-owned firms. That experience expanded her knowledge in a broad range of community development (CD) areas.

As one of the Atlanta Fed’s senior CD advisers and working from the Bank’s Miami Branch, Charly identifies economic barriers that communities face and then connects the communities with information that helps them overcome those challenges. One example is through her involvement with the Southern Cities Economic Inclusion Initiative (SCEI).

Rowing the boat together

The SCEI is a 20-month program led by the National League of Cities, in partnership with the Federal Reserve Bank of Atlanta, Annie E. Casey Foundation, and W.K. Kellogg Foundation. The initiative provides participants in 16 localities access to a network of experts in cities across the Southeast to address issues centered around racial and economic inequities that, if addressed, have the potential to unlock economic growth for all residents. The Atlanta Fed provides data support, research, and facilitation for the partnership. SCEI is funded by the W.K. Kellogg Foundation and the Annie E. Casey Foundation.

Place-based initiatives—long-term programs focused on helping specific underserved locations—like SCEI bring together organizations interested in reaching a shared goal. They are long-term commitments to neighborhoods that aim to achieve better and more sustainable results for their communities. Instead of each group tackling the challenge alone, they maximize impact and resources by “rowing the boat together,” not separately. “The SCEI is a great way to have deep roots in the communities that the Atlanta Fed serves,” Charly said. “This is important given the large geography and diversity represented across the Southeast.”

“Through my professional experiences, it has become clear just how important it is to share the voices of real people with policy makers to help inform their decision-making.”

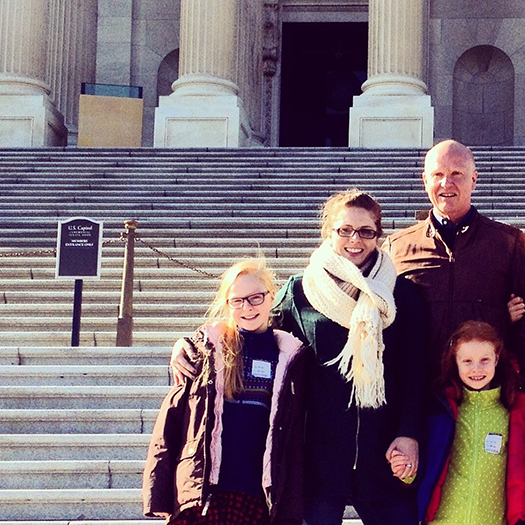

Photo: Charly with her dad and sisters on the Capitol steps. At the time, she was working with the Senate Committee for Small Business and Entrepreneurship.

Accessing credit opens doors to other community investments

Funds can help individuals start and grow a business, send kids to college, and buy a home. In her work, Charly focuses on increasing access to credit, particularly for those who have been systematically denied access to resources. “There are entrenched barriers that prevent people from even having a chance to go after their dreams,” she said. That’s why, when she approaches evolving issues like access to credit, Charly values inclusion and community-designed solutions.

She also considers how technology and globalization can benefit or hinder community efforts. Applying a “think global and act local” approach, Charly focuses on understanding capital absorption—with a focus on how local communities are most effectively able to prepare for and use the funds they secure—throughout the Southeast. Harvard defines capital absorption as a community’s ability to effectively use private investment capital to serve pressing needs. There is a focus on understanding community investment as an ecosystem with different kinds of actors—public, private, and nonprofit—doing many different activities.

Tying an entrepreneurial spirit to community work

Charly credits her entrepreneurial approach to her work in communities to a long line of family entrepreneurs: Her parents, maternal grandfather, and great grandparents all owned businesses. She remembers stories about her grandmother’s work at the family upholstery business, assisting as the family’s native English speaker, which her great grandparents were not. The business was key to the family’s livelihood, and everyone chipped in to help.

Charly’s experiences led her to pursue an MBA from the University of North Carolina at Chapel Hill to further her skill set in business management. When considering her career, Charly says she “can see the direct link between entrepreneurship and [her] own trajectory.”

Still, it is not lost on her that many lower-income families face additional barriers that impede their entrepreneurial aspirations. That just fuels her mission to address economic inequities and help ensure others have the same opportunities she did.

Finding her place in place-based work

Charly’s current work in the Atlanta Fed’s communities has served to further confirm her passion for placed-based work. Her previous work with the Board of Governors focused on CD programs across the Federal Reserve System, and analyzing place-based initiatives like the Boston Fed’s Working Places Challenge, or the Dallas Fed’s Advance Together initiative. She has also worked at the US Treasury Community Development Financial Institutions Fund. Currently, she serves on the board of directors for Enterprising Latinas, a nonprofit that promotes economic mobility and equity for Latinas in the Tampa Bay area. “Through my professional experiences, it has become clear just how important it is to share the voices of real people with policy makers to help inform their decision-making,” said Charly. “I’ve also realized how important it is to work in your own backyard to understand and solve challenges.”