Gar Kelley, Senior Community Development Advisor, Chicago Fed

His personal and professional life reflect faith, financial empowerment, and service. But what fuels Gar Kelley most is bringing people together. “I’m a matchmaker. I’m a networker. And if I can connect the right people to get things done, I’m all for it.”

From urban communities in the United States to remote villages in Ghana, Gar has masterfully combined his expertise in community development (CD), finance, and strategic planning, with his ministry experiences and passion for helping underserved communities. As a senior advisor in CD and policy studies at the Chicago Fed, Gar helps improve the economic prospects of people and communities who have lower incomes. He collaborates with community leaders to bring development and opportunities to underserved communities, taking into consideration all factors necessary for them to thrive.

One example is through the Community Development Finance in Smaller Markets project, where his team explored the role, types, and benefits of community development financial institutions (CDFIs) in communities where conventional financing may not meet the needs of a community or region. “These convenings have brought awareness of what CDFIs are and how they can increase community investments in ways that financial institutions cannot,” Gar said.

Answering the call

His path to the Fed is a distinguished one. After beginning his career in the corporate finance world, Gar realized his passions and purpose were leading him in a different direction. The church he attended at the time was nationally known for economic development. He led his church’s economic empowerment ministry, whose goal was to advance Black businesses and help them keep dollars in their community.

While doing that work, he decided to attend Princeton’s Theological Seminary, where he earned master’s degrees in theology and divinity. It was there that he met a classmate who worked at the New Jersey Community Loan Fund. Gar joined the loan fund while attending seminary and considers his work at the fund his formal introduction to the CD field.

“During this time at the loan fund, there was a lot of talk about ‘welfare to work,’” he said, of the concept that encouraged people to move closer to self-sufficiency through employment. “As a child who benefited from someone who provided me with childcare in her home while my mother worked, I was motivated to develop a loan product for women who ran in-home childcare centers so they could have the money needed for their businesses and their businesses could be certified to help them gain income,” he said.

“Coming to the Fed was an opportunity to translate research and make language accessible so practitioners could understand and run with it.”

Creating community impact abroad and beyond

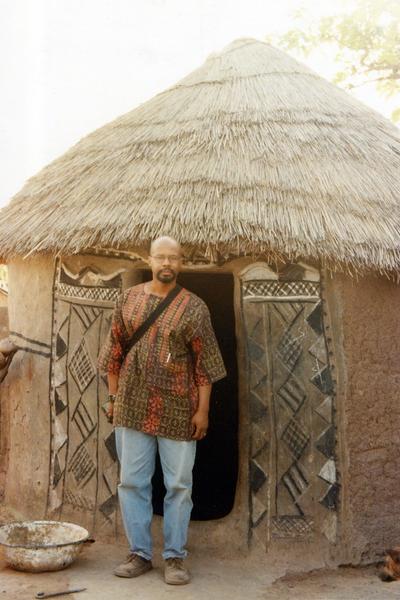

After time in seminary and work at the loan fund, Gar took his passion for economic empowerment to Central and West Africa to serve as a missionary. In Ghana, West Africa, he worked with numerous communities to build schools, clinics, churches, wells, and solar panels. Gar says he was inspired by the work of women in the villages. “In international development circles, we know that if women can make their own money, those funds can be used to send their daughters to school. Then, the girls will have a better chance of bettering their economic futures.”

Gar used donations from the congregation to fund a women’s cooperative there. The cooperative focused on palm nut harvesting. The palm nut has multiple uses that range from cooking to soap products. Upon harvest, the women would sell their products and the profits were evenly distributed.

His work as a missionary evaluating and funding projects eventually brought him back to the United States in a position at Public/Private Ventures leading a national demonstration project. “In various capacities, I’ve always been connected to work that involves the allocation of dollars or investments that can improve communities that we care about,” he said. Senior leader roles at the Association for Enterprise Opportunity (AEO), a national membership organization focused on microbusiness development and the Nonprofit Finance Fund (NFF), a community development finance institution connected him to the Fed.

Hearing the community’s voice

Gar recalls his work at the beginning of the emergence of the fintech—technology used to support or enable banking and financial services—as one of his favorite assignments since joining the Fed in 2015. To promote access to credit, he convened a small business lending ecosystem to explore the opportunities and challenges associated with the new technology. “There was a lot of misinformation during that time,” he said. “We had a good conversation around what fintech was and wasn’t, its opportunities and challenges. CD stakeholders were able to elevate their concerns. We even identified a path forward around things like lending disclosures, loan performance reporting, and the need for diverse products to meet different needs.”

He is also excited about his current work on the Debt Aversion project that seeks to explore the assumption that Black businesses do not like to take on debt to increase their capital. Gar shares that the project will inform the work necessary to provide technical assistance and loan product development to these businesses.

Gar said he greatly appreciates the ability to contribute to his work at the Fed in meaningful ways. “Coming to the Fed was an opportunity to translate research and make language accessible so practitioners could understand it and run with it.” He said he appreciates how the Fed takes a serious look at analyzing the factors that impact communities. He is overjoyed to figure out how to improve our engagement (through the lens of racial equity) with community members and how to include their voices. “I’m just glad we’re beginning to elevate the voices of our communities that are being impacted by the decisions that are made at a very high level,” he said.