Community development financial institutions (CDFIs) are financial institutions with a mission to serve low- and moderate-income (LMI) individuals and communities. They can be depository institutions (including banks and credit unions) and nondepository institutions (including loan funds, venture capital funds, and community development corporations). Provided they meet established criteria, the Department of the Treasury’s CDFI Fund may certify CDFIs in order for them to receive capital support.

From March 22 through May 14, 2021, the Federal Reserve fielded the 2021 CDFI Survey. The effort gathered information from 345 CDFIs on their financial well-being throughout the COVID-19 pandemic, operational gaps and challenges, and effects on clients and communities they serve. Survey results and key findings are organized into the following sections.

Key takeaways from the 2021 CDFI Survey include:

- CDFIs indicated a widespread influx of new customers, strong funding streams throughout the pandemic, and generally positive current financial states. In last year’s special COVID-19 CDFI Survey, CDFIs had expressed concern about their ability to respond to the COVID-19 pandemic financially.

- Among CDFIs that provided client information in the 2021 survey, almost all took on new clients since March 2020. Many new clients were directly tied to COVID-19 pandemic funding, including those seeking access to pandemic financial assistance programs, and those seeking technical assistance for loan and grant applications.

- Four out of five respondent CDFIs described their current financial state as moderately strong or very strong, with nearly half indicating very strong.

- More than three-quarters of respondent CDFIs indicated they were unable to provide all the products or services they would like to offer on a sustained basis. The majority of these CDFIs cited limited staffing and capital as constraints.

- Most respondent CDFIs said that loss of income or revenue was the most significant challenge facing their clients in 2020 and 2021.

This survey effort is a partnership of the Federal Reserve, the CDFI Fund, Opportunity Finance Network, the Alliance of African American CDFI CEOs, CDFI Coalition, the Native CDFI Network, the Community Development Bankers Association, Inclusiv, First Nations Oweesta Corporation, NeighborWorks America, the New York State CDFI Coalition, and the Asociación de Ejecutivos de Cooperativas de Ahorro y Crédito de Puerto Rico.

Organizational status, capacity, and change

Top lines of business

In 2021, 61 percent of respondent CDFIs reported small business lending as a primary or secondary line of business. Forty-two percent reported consumer lending as a primary or secondary line of business, followed by affordable housing lending (39 percent), residential real estate lending (36 percent), and commercial real estate lending (32 percent).

Prior to the COVID-19 pandemic, in the 2019 CDFI Survey, 51 percent of respondent CDFIs reported small business finance as either their primary or secondary line of business. Consumer finance was a primary or secondary line of business for 41 percent CDFI respondents in the 2019 survey.

Well-being of CDFIs

At the time the 2021 survey was fielded, 81 percent of respondent CDFIs described their financial state as “strong” (with 46 percent responding “very strong”). Thirteen percent felt their organizations were “okay” financially. At the time of the 2020 special COVID-19 CDFI Survey, there were widespread concerns regarding finances, including maintaining pre-pandemic levels of loan loss reserves. Despite most respondents reporting strong financial states in 2021, many CDFIs still expressed operational and financial concerns. Respondents ranked operational support as the most important type of assistance that would help them fulfill unmet need, followed by support with equity capital/secondary capital, and loan loss reserve support third.

Six percent of respondent CDFIs reported they were struggling at the time of this survey, as they revealed challenges with staffing and limited capital. Of the nine struggling CDFIs that responded to questions about funding sources, seven reported loss of equity from retained earnings. The stresses of the pandemic were evident among these institutions. One detailed a severe disruption to a funding stream: “We ceased lending in [March 2020] as our lenders pulled their funding for the purchase of our loans until the pandemic ends.” Another wrote: “We have had to curtail our credit practices of helping people repair their credit and get away from predatory lenders due to loan losses incurred.”

Funding streams

To better understand CDFI financial states, we asked how capital sourcing had changed since March 2020. As we have learned from past CDFI surveys, top external sources of funding include federal, state, and local governments and regulated financial institutions. Nondepository CDFIs were asked how their inflow of debt capital (money borrowed from external sources) changed since March 2020. More than three-quarters (163 respondents) said they receive investment from the federal government — of which more than 94 percent reported an increase or no change in its debt capital funding. Fewer CDFIs received capital from their state or local government (102 respondents), but 98 percent experienced an increase or no change from those sources.

Debt capital flowing from banks also generally increased or stayed the same. About 71 percent of nondepository institutions source capital from regional banks — of which 90 percent increased or maintained funding. Largely, there was no change in community bank funding. Fourteen percent of nondepository respondents reported that large banks were decreasing funding — the largest report of a decrease across funding sources.

CDFIs’ sources of equity followed the same general pattern — with most increasing or maintaining levels from March 2020. Separately, out of 121 depository institutions, 19 had subordinated debt — most of which (10 respondents) saw increases from various sources since March 2020.

Compared to the 2020 COVID-19 CDFI Survey (which asked about funding from March 2020 to June 2020), respondents reported slightly more changes in investment across the board, but funding streams remained strong throughout the pandemic. This is reflected in generally positive financial status reports from respondent CDFIs. But with an influx of new customers during the pandemic (further discussed in the “Clients and Communities” section below), many respondents detailed challenges in providing more financial services to their clients and communities.

Products

More than three-quarters of respondent CDFIs (263 respondent organizations) want to offer products that they could not offer at the time of the survey. The most common product types that CDFIs reported wanting to offer were U.S. Small Business Administration (SBA) and other small business loans (89 respondents), mortgages (64 respondents), online accounts and lending (54 respondents), and technical assistance or financial coaching (50 respondents).

Respondent CDFIs who reported being in a stronger financial position were less likely to report that they want to offer products they could not offer at the time of the survey.

Responses to “Are there products and/or services that your CDFI aspires to provide on a sustained basis that it currently provides on a temporary basis or that it cannot currently provide?” by reported financial state

| Financial state | Yes Percentage (N) | No Percentage (N) |

|---|---|---|

| Very Strong | 66% (103) | 34% (54) |

| Moderately Strong | 83% (103) | 17% (21) |

| Okay | 84% (37) | 16% (7) |

| Moderately Struggling | 100% (15) | 0% (0) |

| Significantly Struggling | 100% (4) | 0% (0) |

Among respondent CDFIs who want to offer additional products, the top identified challenges preventing delivery of desired products were challenges with staffing (68 percent), limited capital (58 percent), and lack of necessary skills within their organization (46 percent).

Clients and communities

CDFI clients by business line

In the wake of economic challenges caused by the COVID-19 pandemic, CDFI respondents helped clients and customers navigate challenges by providing direct financial services with flexible terms, facilitating access to federal and state funding, and offering technical assistance. In 2021, consumer clients made up 64 percent of the total clients served by respondent CDFIs, and small business made up 29 percent of total clients1. Clients receiving residential lending services comprised the balance among survey respondents (7 percent of total clients). Depository institutions served 90 percent of the clients receiving consumer financial services. Nondepository institutions served 85 percent2 of the small business lending clients represented in the survey.

Of the 275 CDFIs that provided client counts, 94 percent reported taking on new clients with whom they had no relationship prior to March 2020. Seventy-six percent of nondepository institutions and 45 percent of depository institutions reported new small business clients. Nearly three-quarters of depository institutions reported new clients for their consumer financial product services, and 51 percent cited new residential lending clients. Depository institutions served a median of 300 new clients across business lines, while the median number of new clients for nondepository institutions was 70. This varied across business lines. (See table below.)

Client counts, by reported business line

| Count of CDFIs reporting any clients by business line | Count of CDFIs reporting any new clients, by business line | Median number of new clients by business line | Total clients by business line | |||||

|---|---|---|---|---|---|---|---|---|

| Nondepository (n=170) | Depository (n=105) | Nondepository (n=170) | Depository (n=105) | Nondepository (n=170) | Depository (n=105) | Nondepository (n=170) | Depository (n=105) | |

| Small business lending 3 | 138 | 53 | 129 | 47 | 40 | 200 | 701,756 | 66,518 |

| Consumer financial products | 37 | 86 | 35 | 77 | 110 | 464 | 51,705 | 1,651,783 |

| Residential lending | 40 | 83 | 35 | 54 | 52 | 73 | 71,332 | 114,960 |

The economic consequences of the COVID-19 pandemic were evident in types of clients that CDFIs served during the pandemic. Respondents noted trends in new clients that were directly tied to COVID-19 pandemic funding, including those seeking access to pandemic financial assistance programs and those seeking technical assistance for loan and grant applications. Seventy-one respondents cited an influx of small businesses and sole proprietorships applying for Paycheck Protection Program (PPP) funds or seeking PPP-related support. Respondents also mentioned clients seeking COVID-19 Economic Injury Disaster Loans (EIDL) to support their small businesses. Some respondents noted an increase in consumer clients who, upon receiving stimulus checks and enhanced unemployment benefits, were interested in paying down debt and increasing savings.

New client demand for CDFI services fueled directly by federal and state funding for pandemic relief will likely wane as the relief programs end. However, many respondents reported an influx of new clients seeking services that were not directly tied to pandemic-era assistance programs. Twenty respondents noted that clients sought financing for startups and entrepreneurial pursuits.

CDFIs also reported new clients seeking financial services and technical assistance for basic banking needs, credit access, and homebuying. Among these CDFIs, 22 respondents noted many of their new clients were unbanked or underbanked, meaning they had relied on nontraditional financial services, like payday loans, pawnshops, or check-cashing services, and 18 respondents noted their increase in new client business was driven by individuals with limited or no credit history. Several respondents mentioned clients seeking funds for immigration filing requirements, and 11 respondents noted an uptick in clients who were pursuing home ownership, some of whom were struggling to find affordable housing in their area and were seeking down payment assistance and other resources. The pandemic not only amplified many of the economic challenges that consumers and businesses in LMI communities face, but also may have created new opportunities for credit building, entrepreneurship, and business evolution.

Challenges facing LMI communities

The relationships CDFIs have with consumers, small businesses, and nonprofit organizations give them a unique perspective on the challenges facing the LMI communities they serve. When asked about the most significant challenge to customers, clients, and members, 76 percent of the CDFI respondents (80 percent of nondepository and 70 percent of depository institutions) cited income or revenue loss as the largest challenge facing their clients in 2020. The majority of respondents (69 percent) believed income or revenue loss would continue to be the largest challenge facing clients in 2021. Fourteen percent of respondents cited health, basic needs, and child care and/or education as the most significant challenge for their clients. Nearly all of them represented depository institutions, which serve more consumers than nondepository institutions.

Of the 29 respondents who indicated “other” for the top challenge in 2020, 34 percent cited the COVID-19 pandemic or a related consequence as the biggest challenge. Respondents mentioned COVID-19 as a challenge facing clients in 2021, but there were more specific concerns on navigating the uneven economic recovery. Respondents also cited clients’ various concerns on businesses reopening. Some mentioned uncertainty about pandemic restrictions and adapting to new safety requirements, and others cited a lack of inventory, supply chain issues, rising prices, and workforce shortages. Several respondents noted small business concerns about having to rebuild their customer base after a long period of closures and reduced in-person services. Other respondents mentioned access to capital would be a challenge for their clients.

Meeting community needs

To help their clients and communities manage economic challenges, respondent CDFIs provided a range of financial services and technical assistance to clients across three lines of business. (See table below.) Many survey respondents extended capital access in the form of loans and grants. Sixty-eight percent of CDFIs reported small business clients receiving PPP or EIDL loans or grants, and 58 percent of respondents reported clients receiving technical support for the PPP or EIDL application process. A frequent form of support that these CDFIs provided was loan modification to more than 43,000 clients across small business, residential lending, and consumer product lines. Within the residential real estate lending business line, half of CDFIs in the survey provided loan forbearance to 5,198 clients.

Percent of respondent CDFIs reporting any clients received these products, by business line

| Small business lending clients (n=191) | Residential real estate lending clients (n=123) | Consumer financial products clients (n=123) | |

|---|---|---|---|

| Additional grant capital for any purpose | 44% | 18% | 15% |

| Additional loan capital for any purpose | 59% | 25% | 28% |

| PPP/EIDL loan or grant | 68% | 2% | 1% |

| Loan modification, including change in loan type, term, and/or interest rate | 68% | 43% | 55% |

| Forbearance | 42% | 50% | 40% |

| Waived fees | 30% | 20% | 44% |

| PPP/EIDL technical support | 58% | 2% | 2% |

| Other technical support | 48% | 18% | 15% |

| Other (e.g., refinance) | 6% | 12% | 11% |

Other services CDFI clients received included loan refinancing, the ability to skip loan payments, down payment assistance, and financial coaching. Respondents also mentioned innovative strategies and products their CDFIs were pursuing to support the changing needs of their clients and members. Several CDFIs mentioned increasing online and mobile financial services, and others mentioned helping small business clients develop and expand online and e-commerce options. Another trend among CDFIs was initiatives around microloans and other small-dollar financial products designed to increase access to capital for low-income and minority communities.

1 Includes client totals for one CDFI that reported a high number of PPP clients. Excluding this observation, the composition of clients served by CDFIs in this survey is as follows: Small business clients (8 percent); consumer clients (83 percent); residential lending clients (9 percent).

2 Includes one nondepository CDFI that reported a high number of new small business clients within the PPP program, not all of which ultimately received PPP loans. Without these clients included, nondepository institutions served 60 percent of the small business clients, and depository institutions served 40 percent.

3 Includes one CDFI that reported a high number of new clients related to the PPP program.

Survey respondent overview

Organization type

This year’s survey fielded responses from 345 CDFIs, of which 328 were certified — representing 27 percent of all CDFIs certified by the CDFI Fund. Like the population of certified CDFIs, the majority of survey respondents were Community Development Loan Funds and Credit Unions. Banks represented nine percent of survey respondents, and credit unions represented another 18 percent. The remaining respondents identified their organizations as venture capital funds, community development corporations, and depository institution holding companies, covering all organizational types recognized by the CDFI Fund.

Survey respondents also had the opportunity to identify themselves based on the communities they serve. Namely, 25 survey respondents, or seven percent of the sample, identified as cooperativas, which are community development credit unions based in Puerto Rico. Approximately half of Puerto Rico’s 31 certified cooperativas are represented in the survey in addition to eight cooperativas with a pending certification or technical assistance application. The survey also attracted responses from Minority Depository Institutions (MDIs) and Native CDFIs. The Federal Deposit Insurance Corporation (FDIC) defines an MDI as any depository institution where one or more minority individuals own most of the stock. Eight percent of the institutions that responded to the CDFI survey were MDIs, representing seven percent of all MDIs recognized by the FDIC. Separately, seven percent of respondents identified themselves as Native CDFIs, or institutions dedicated toward strengthening Native communities. These respondents represent a third of all Native CDFIs recognized by the CDFI Fund.

Geographic coverage

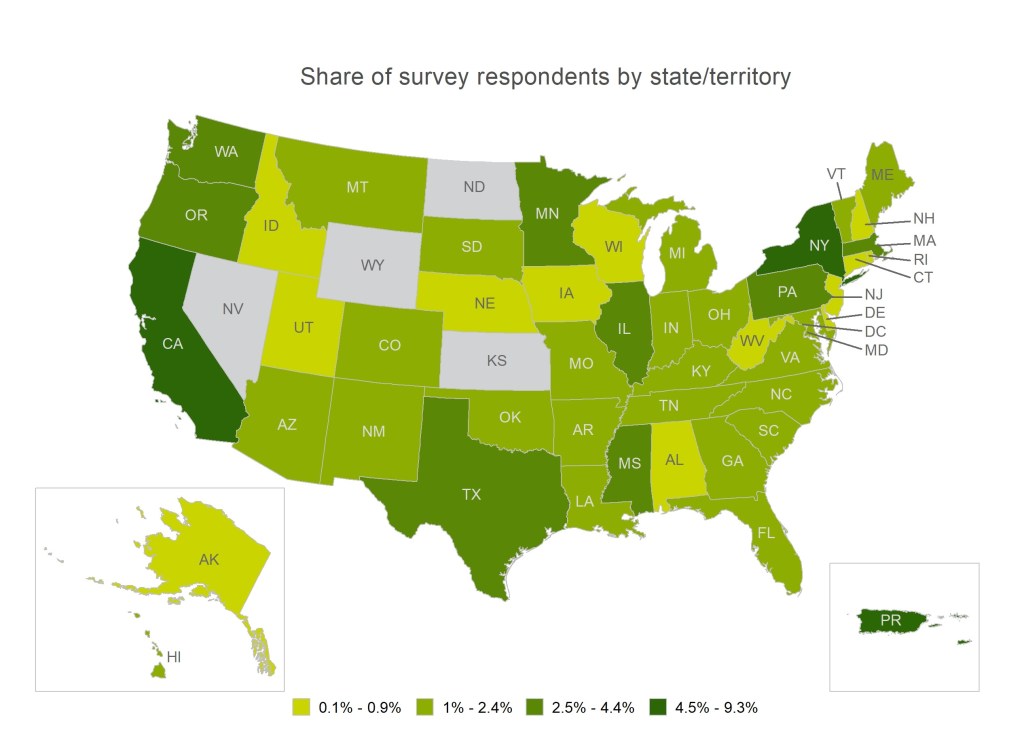

This year’s survey included responses from 46 states, the District of Columbia, and Puerto Rico. The states and territories with the largest number of responses were California (32 respondents), Puerto Rico (27 respondents), and New York (25 respondents). California and New York in fact have the second and third highest number of certified CDFIs in the nation, only following Mississippi, which has 103 certified CDFIs. Puerto Rico comes 10th in total certified CDFIs. The chart below provides the number of total respondents and the number of certified CDFIs not represented in the survey for each state. The map that follows shows the share of survey participants by state/territory.

The survey data also indicate that most CDFIs focus on the community located within their state or territory. Seventy-two percent of respondents served a single state or territory; twenty-eight percent served a geography covering multiple states. While respondent CDFIs tend to focus on the state in which they are located, they cover multiple geographic types. For instance, over half of all respondents serve both urban and rural communities. Overall, urban communities were served by 77 percent of respondents, suburban communities were served by 60 percent of respondents, and rural communities were served by 75 percent of respondents.

Customer demographics

To be a certified CDFI, an organization must serve one or more eligible target markets, which include economically distressed investment areas, low-income communities, and historically underserved minority populations.

A family is designated as low income if its earnings fall below 80 percent of the area median income. As the chart below shows, nearly two-thirds of CDFIs that reported client income information serve clients that are majority low income, and a third of respondents serve clients that are over 75 percent low income.

The minority populations recognized by the CDFI Fund as targeted communities include Hispanics, African Americans, Pacific Islanders, and the native population. Seventy-three percent of respondent CDFIs serve clients that are mostly composed of ethnic and racial minorities. Approximately one-fifth of respondents serve clients that are majority Hispanic, and another 21 percent of respondents serve clients that are majority African American.

Additionally, 42 percent of respondents indicated having a written strategic plan or policy related to racial equity. These included commitments to staff and board diversity; equity, diversity, and inclusion committees; and explicit partnerships with rights and justice organizations.

The National CDFI Directory is updated every two years when the CDFI Survey is fielded. Currently, it contains contact information for 319 CDFIs that responded to the 2021 survey. Separately, the CDFI Fund maintains a full list of Certified CDFIs.