The spread of COVID-19 and the many efforts to slow it are impacting communities throughout the nation. To best respond to this crisis, information is needed about the scope and scale of challenges in various communities. This report offers findings of a survey designed to collect information on the effects of COVID-19 on low- to moderate-income people and communities and the entities serving them. The survey was fielded by eight national partners and the Federal Reserve System’s community development function.

This survey provides an insightful and informative snapshot of how COVID-19 was affecting people and organizations on the dates the survey was administered. The current report is based on data collected through a convenience sample. Readers should not compare findings in this report to similar surveys conducted in 2020.

Main findings for people and communities served by the respondent’s entity:

- Economic conditions: When asked about the peak of distress, 86% indicated COVID-19 was a significant disruption to the economic conditions of the communities they served, while 44% indicated experiencing significant disruptions at the time of the survey period (figure 1).

- Small-business disruptions: 60% said that COVID-19 was causing a significant disruption to small businesses (figure 2), with 81% saying the latest conditions were still worse than they were pre-pandemic (figure 3).

- Disruptions to services for children: More than half (57%) said that COVID-19 was causing a significant disruption to services for children (figure 2), with 77% noting that conditions were still worse than they were pre-pandemic (figure 3).

- Disruption to financial stability: 94% said that COVID-19 was causing disruptions (51% said significant disruptions) to financial stability (figure 2), with 78% stating that conditions were still worse than they were pre-pandemic (figure 3).

- Time to recovery: Across almost all categories, half the respondents estimated it will take one to three years to return to pre-pandemic conditions. Almost a quarter of respondents noted that it would take four or more years for housing stability to return to pre-pandemic conditions (figure 4).

- Critical resources: More than 60% noted that federal stimulus checks, small-business support, unemployment benefits and rent relief were critically important for the people and communities they serve (figure 5).

Main findings for entities represented by the respondents:

- Disruption to entities: Almost 70% indicated COVID-19 significantly disrupted the entities they represent during the peak of distress, whereas one-third of respondents indicated the same for the latest survey period (figure 7).

- Demand for services: Almost 70% of respondents indicated that demand for their services increased compared with pre-pandemic levels (figure 8).

- Ability to provide services: 35% noted an increase in their ability to provide services, whereas slightly less than half (46%) noted a decrease in ability to serve. Almost 70% indicated that their expenses had increased compared to pre-pandemic levels (figure 8).

- Financial health: More than half of the respondents said the pandemic had a negative impact on their entities’ financial health (figure 10), and 60% of those respondents indicated their entities could operate for less than a year in the current environment before exhibiting financial distress (figure 11).

Impact of COVID-19 on low- to moderate-income communities

Most respondents (86%) indicated that during the peak of the COVID-19 pandemic, the people and communities they serve experienced significant disruption. However, fewer than half the respondents said the same about the survey period.

Figure 1

* "Peak" data came from two different questions within the survey:

- Thinking about the period of peak of distress caused by the pandemic, what level of disruption did COVID-19 have on economic conditions in your community at that time?

- Currently, what level of disruption is COVID-19 having on economic conditions in your community?

When asked about specific segments of the economy, respondents noted that the level of disruption varied. Nearly 60% of respondents noted a significant disruption for small businesses and services for children, while one-third noted the same about disruptions to basic consumer needs. Slightly more than half indicated significant disruptions to financial stability and housing stability.

Figure 2

When asked to compare to pre-pandemic conditions, many respondents indicated conditions were worse during the survey period (Aug. 3-27), across several categories.

Figure 3

Those who said that conditions were worse than before the pandemic (at least two-thirds of respondents) were asked how long it would take their communities to get back to pre-pandemic conditions. Across most categories, half of respondents estimated that it would take one to three years to return to pre-pandemic conditions. In terms of housing stability, an even slower recovery was expected, with a quarter of respondents saying it would take four or more years to recover fully. Almost a quarter also noted that pre-pandemic conditions may never return for small businesses and housing stability.

Figure 4

Note: Only respondents who said that conditions were worse compared to pre-pandemic conditions answered this question.

Resources and challenges during the pandemic

More than 60% of respondents noted that resources made available during the pandemic—such as stimulus checks, small business supports, unemployment benefits and rent relief—were very critical. Almost half of the respondents noted the same for advance child tax credit payments, which were deployed more recently.

Figure 5

While respondents reported the resources noted above were critical, 80% indicated that not being able to access government funding (due to lack of eligibility or capacity for processing applications) as well applying for funds (including a complex process, burdensome paperwork and lack of internet access), were challenges or significant challenges. More than 90% of respondents indicated that returning to work was a challenge for various reasons, including lack of child care and public transportation and the risk of being exposed to COVID-19.

Figure 6

Impact of COVID-19 on entities serving low- to moderate-income communities

Disruptions to entities also revealed a similar pattern of recovery. Almost 70% reported that they experienced significant disruption during the peak of COVID-19, whereas only one-third noted the same during the survey period.

Figure 7

Almost 70% of the entities noted increased demand for their services compared with pre-pandemic conditions. Although, 35% noted an increase in their ability to provide services, almost half said the opposite. Similarly, 40% indicated a decrease in staffing levels and almost 70% mentioned that their expenses had increased compared to pre-pandemic conditions.

Figure 8

Almost half the respondents noted a decrease in individual and corporate donations. More than a third did note an increase in funding from foundations, whereas almost 60% indicated that they saw an increase in government funding.

Figure 9

Overall, more than half (51%) indicated that COVID-19 had a negative impact on their organizations’ financial health. Almost a quarter (24%) did note that the pandemic had a positive impact on their financial health.

Figure 10

Of the respondents who said COVID-19 had a negative impact on their financial health, almost 60% noted that if current conditions were to continue, they would exhibit financial distress, including reducing services, laying off staff, closing locations or shutting down entirely.

Figure 11

Note: Only respondents who said COVID-19 had a negative impact on the financial health of their entities responded to this question.

Respondent profiles

Survey administrators reached out to various entities serving diverse demographic groups and worked on a broad range of issues.

Figure 12

What issues do you work on? N=3247

| Child Welfare and Family Well-Being | 59% |

| Consumer Finance | 70% |

| Education | 52% |

| Food | 90% |

| Health | 90% |

| Housing | 49% |

| Older Adults | 30% |

| Small Business | 20% |

| Workforce Development/Jobs | 36% |

| Other Issues Not Listed Above | 21% |

Eighty-five percent of surveyed entities were direct service providers that gave aid to many groups of people—including older adults, youths and people with disabilities.

Figure 13

Figure 14

Does the entity you represent serve any of the following populations? N=3325

| Immigrants | 80% |

| LGBTQIA+ | 84% |

| Older Adults | 90% |

| People Experiencing Homelessness | 80% |

| People with Disabilities | 93% |

| Veterans | 83% |

| Youths | 93% |

| Additional Groups Not Listed Above | 12% |

While the types of entities included financial institutions, government agencies and educational services providers, most respondents were from nonprofit organizations.

Figure 15

Half these entities served primarily urban areas (55%), while one-third served primarily rural areas (31%).

Figure 16

Note: Percentages were calculated based on the categories being ranked first.

Half the respondents noted that they primarily served communities of color, including multiple racial and ethnic groups.

Figure 17

Figure 18

Demographics of the communities of color served by responding entities: N=1562

| Community demographics | Provide Services | Primarily Serving (50%+) |

|---|---|---|

| American Indian or Native Alaskan | 59% | 4% |

| Asian | 70% | 3% |

| Hawaiian or Pacific Islander | 52% | 2% |

| Hispanic or Latino | 90% | 30% |

| Non-Hispanic Black or African American | 90% | 37% |

| Additional Race/Ethnicities Not Listed Above | 49% | 3% |

Figure 19

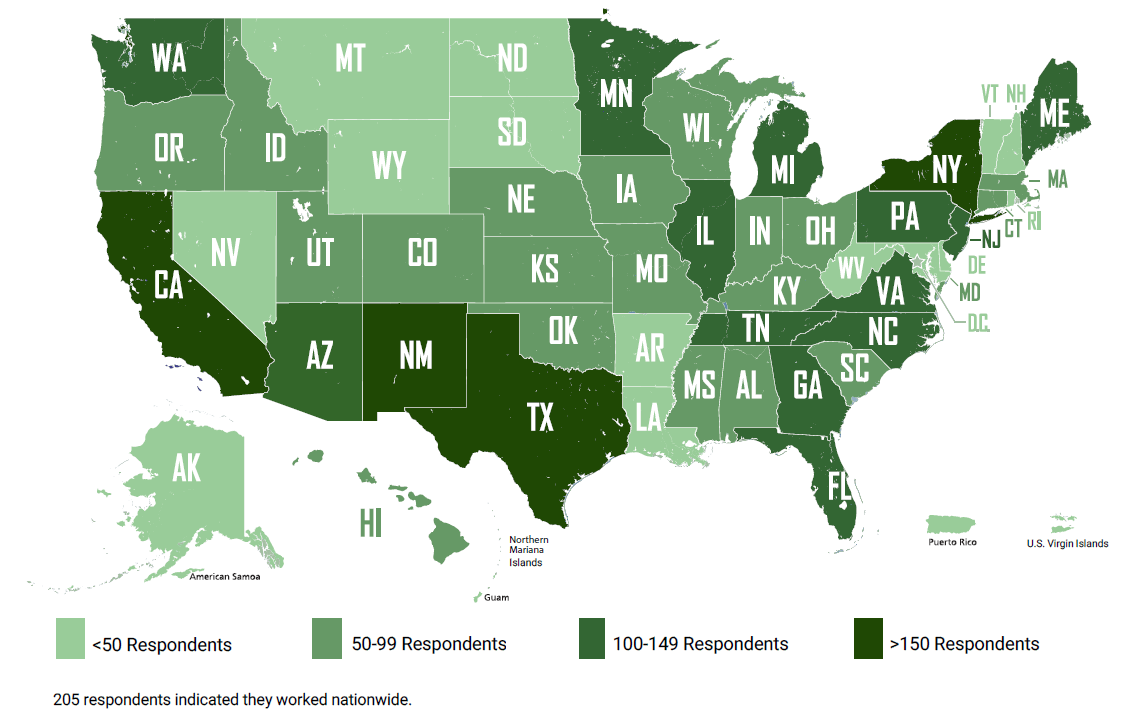

In which states and/or territories do you conduct most of your work? Select all that apply.

Survey methodology and terms

The survey was administered between Aug. 3 and Aug. 27, 2021. There were approximately 5200 total responses. However, only 3681 entities responded to most of the survey including the questions related to being a direct service provider or not as well as COVID19’s level of disruption during the peak of the pandemic and at the time of the survey.

Responses were collected through a convenience sampling method that relied on contact databases to identify representatives of nonprofit organizations, financial institutions, government agencies and other community organizations. These representatives were invited to participate in the survey via emails, newsletters and social media posts. Similar surveys were conducted in 2020.

Terms

Financial Stability: Refers to income loss and changes to income stability.

Impacts on Small Businesses: Refer to short- and long-term closure, supply chain disruptions and reduced demand.

Impacts on Access to Health Care: Refer to access to health insurance and mental health services.

Impacts on Services for Children: Refers to changes in availability of early child care and education, access to child welfare services and adequate access to K-12 education.

Housing Stability: Refers toevictions, back rent, foreclosures and homelessness.

Basic Consumer Needs: Refers to food, household essentials and other personal needs.

Entities Exhibiting Financial Distress: Includes reducing services, laying off staff, closing locations or shutting down entirely.

Report authors

Citing this work

Views expressed are those of the report team and do not necessarily represent the views of the Federal Reserve System. Please cite this report as: Chalise, Nishesh and Gutkowski, Violeta. "Perspectives from Main Street: The Impact of COVID-19 on Low- to Moderate-Income Communities and the Entities Serving Them," October 2021.

Acknowledgements

The Federal Reserve’s community development function seeks to promote the economic resilience and mobility of low- to moderate-income (LMI) and underserved households and communities across the United States. We thank the following survey team members for their contributions.

Survey advisors

Daniel Paul Davis, Federal Reserve Bank of St. Louis

Michael Grover, Federal Reserve Bank of Minneapolis

David Kaufmann, Board of Governors of the Federal Reserve System

Karen Leone de Nie, Federal Reserve Bank of Atlanta

Survey core group

Jasmine Burnett, Federal Reserve Bank of Atlanta

Nishesh Chalise, Federal Reserve Bank of St. Louis

Violeta Gutkowski, Federal Reserve Bank of St. Louis

Heidi Kaplan, Board of Governors of the Federal Reserve System

Jason Kosakow, Federal Reserve Bank of Richmond

Report assistance

Matuschka Lindo Briggs, Federal Reserve Bank of St. Louis

Mark Davis, Federal Reserve Bank of Cleveland

Maria Hasenstab, Federal Reserve Bank of St. Louis

Lindsay Jones, Federal Reserve Bank of St. Louis

Bianca Phillips, Federal Reserve Bank of St. Louis

Survey fielding team

Nathaniel Borek, Federal Reserve Bank of Philadelphia

Jeremiah Boyle, Federal Reserve Bank of Chicago

Surekha Carpenter, Federal Reserve Bank of Richmond

Molly Hubbert Doyle, Federal Reserve Bank of Dallas

Emily Engel, Federal Reserve Bank of Chicago

Laurel Gourd, Federal Reserve Bank of San Francisco

Jennifer Leak, Federal Reserve Bank of Atlanta

Edison Reyes, Federal Reserve Bank of New York

Lauren Shelby, Federal Reserve Bank of Chicago

Steven Shepelwich, Federal Reserve Bank of Kansas City

Libby Starling, Federal Reserve Bank of Minneapolis

Jennifer Wilding, Federal Reserve Bank of Kansas City

Paula Woessner, Federal Reserve Bank of Minneapolis

National partners

The Federal Reserve System thanks the following organizations and individuals for their support. Partners helped review the survey design and recruited survey participants.

Alliance for Strong Families and Communities and Council on Accreditation; represented by Ilana Levinson, Rehana Absar and Derry Kiernan.

Local Initiatives Support Corporation; represented by Matt Josephs, David Greenberg and Tanya Chin Ross.

National Alliance of Community Economic Development Associations (NACEDA); represented by Frank Woodruff, Suzanne Gunther and Jeremy Brownlee.

National Community Action Partnerships; represented by Denise Harlow, Lana Shope and Ryan Gelman.

National Council of Nonprofits; represented by Amy Silver O’Leary and Rick Cohen.

National Fund for Workforce Solutions; represented by Amanda Cage.

National Urban League; represented by Traci Scott.

NeighborWorks America; represented by Michael Butchko.

Subscribe to Perspectives from Main Street

Sign up to receive an email notification when future Perspectives from Main Street surveys and survey findings are available. Unsubscribe at any time.