Community Development Financial Institutions (CDFIs) provide lending to small businesses, nonprofits, and microenterprises in minority communities and geographically underserved areas. In the face of COVID-19, CDFIs have flexed to meet the expanded needs of at-risk businesses and individuals in their communities. But recent survey findings also indicate that many CDFIs may feel at-risk themselves.

Why surveying the CDFI industry matters

Understanding the health of the CDFI industry is vital. CDFI survival is often crucial to a community—from the local CDFI employees to the small businesses, individuals, and community projects relying on CDFI funding.

Every other year, the Federal Reserve conducts a national survey of community development financial institutions. CDFIs are entities such as banks or credit unions that provide financial services to residents and businesses in traditionally underserved communities.

Prior to the COVID-19 pandemic, CDFIs had their hands full with the goal of expanding economic opportunity in low-income communities. But as the recent survey results indicate, COVID-19 created an even greater demand for CDFI products and services, as small businesses across the country looked to CDFIs as a channel for financial relief. Lending exploded. For instance, AltCap, a Midwestern CDFI, in 2019 made fewer than 50 small-business loans; between March and mid-August of this year, the lender made 178 such loans.

To read more about AltCap’s pandemic experience and its impact on a Kansas City-based cheesesteak restaurant, check out “A Real Trying Time,” the third in a series of stories related to small-business owners and community lenders who have come together to persevere through the pandemic.

Key takeaways from this year’s survey

CDFIs are adapting. As customers’ needs are changing, CDFIs are modifying their support through offerings such as loan refinance, microloan programs, limited interest-only payments, and even payment deferrals. One example of a CDFI’s going above and beyond to support its customers is the Rural Community Assistance Corporation (RCAC), based in California. As detailed in “A Fish with Very Little Water,” RCAC staff sometimes travel via helicopter, snowmobile, or mule to reach their clients in remote areas.

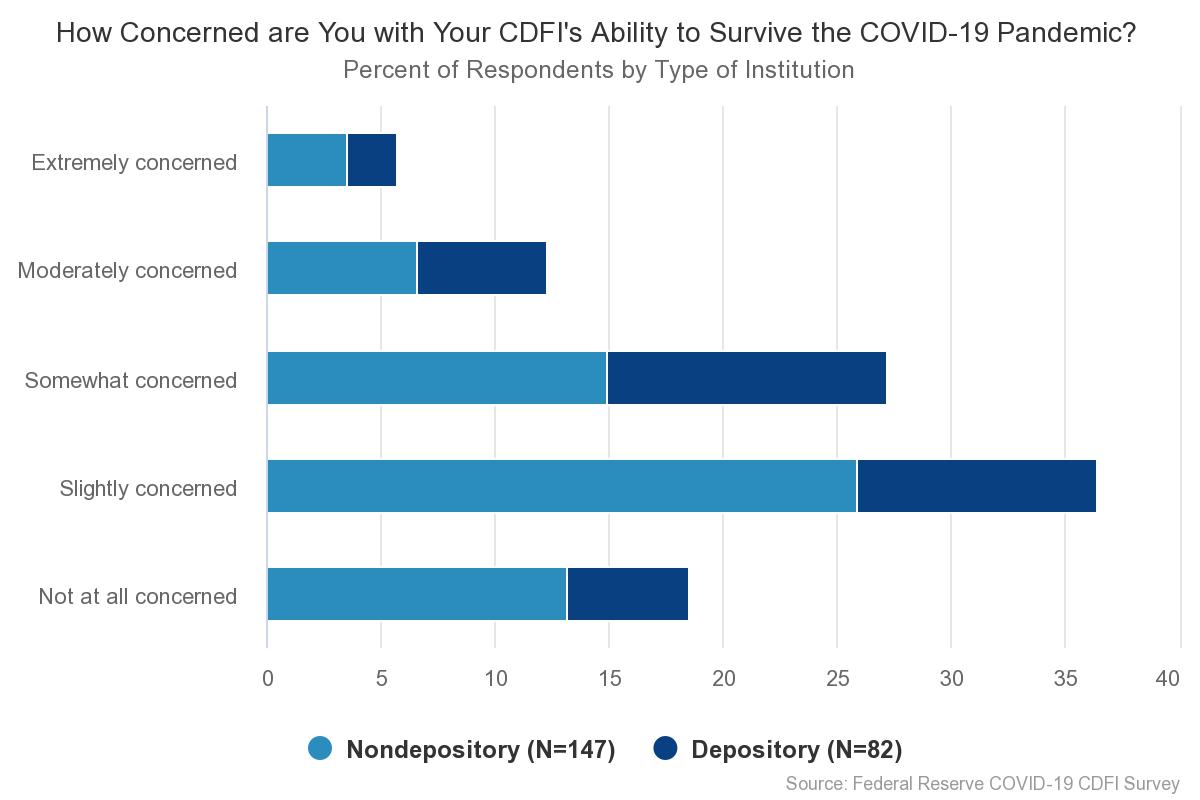

CDFIs worry about their own survival. While CDFIs are pulling out all the stops to support their customers, many CDFIs are also worried about their own operations and financial strength. Noted one survey respondent, “We have done very well during the crisis…But we are very worried that as the virus rages on and the economy teeters on collapse, our clients are going to begin to default on loans.” Most survey respondents expressed at least some concern about their CDFI’s ability to survive the COVID-19 pandemic, with more than half noting decreases in revenue between March and June this year.

How these survey results can help

CDFIs have become an essential funding source for many small businesses, organizations, and individuals in jeopardy as a result of the pandemic. But while CDFIs flex to meet the needs of their communities, they must also keep an eye on their own portfolios. After all, a CDFI with no money to lend is not very helpful to a struggling business owner. The Federal Reserve assists in this realm, sharing the CDFI Survey results with industry groups and using them to connect funders, such as traditional banks and foundations, to the needs of CDFIs and their communities.

Dive into the COVID-19 CDFI Survey report, and explore this series of inspiring stories about small lenders’ connecting with small businesses during the pandemic.