The Federal Reserve Bank of New York will host a virtual event focused on investment strategies that address the social determinants of health.

|

Monday

|

Tuesday

|

Wednesday

|

Thursday

|

Friday

|

Saturday

|

Sunday

|

|---|---|---|---|---|---|---|

|

0 events,

|

0 events,

|

0 events,

|

2 events,

–

The Federal Reserve Bank of New York will host a virtual event focused on investment strategies that address the social determinants of health.

Free

–

Rising energy costs, the impacts of shifting average local temperatures, and the increasing frequency of extreme weather events and disasters create challenges for low- and moderate-income (LMI) households. With federal funding flowing to communities for climate resilience, there is opportunity for investment in LMI communities.

Free

|

0 events,

|

0 events,

|

0 events,

|

|

1 event,

–

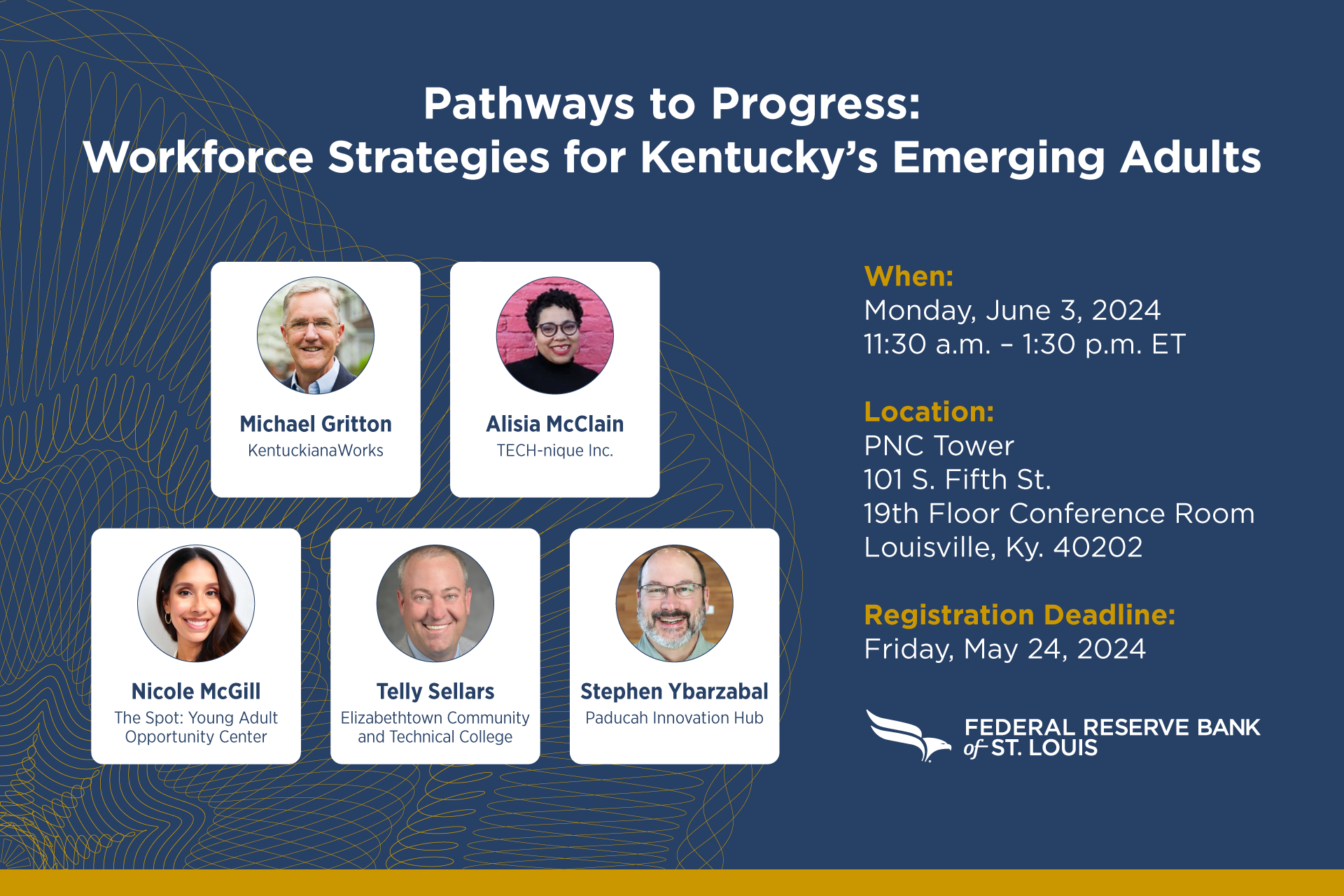

Join us to hear from business and industry leaders, community organizations and educational partners from across the state who have deployed successful approaches to addressing many of the challenges that hinder young adults from participating more fully in the labor market, such as those involving housing, transportation and child care.

Free

|

1 event,

–

Join the Community Development department at the St. Louis Fed for the next event in our Conversations on Equity series, which will explore how grant funding plays a pivotal role in the pursuit of economic equity.

Free

|

0 events,

|

0 events,

|

0 events,

|

0 events,

|

0 events,

|

|

0 events,

|

0 events,

|

0 events,

|

0 events,

|

0 events,

|

0 events,

|

0 events,

|

|

0 events,

|

0 events,

|

0 events,

|

1 event,

–

How did inflation affect families last year? Did trends shift in the use of emerging financial products? Join the Federal Reserve Board of Governors for a discussion that will explore findings from the Survey of Household Economics and Decisionmaking (SHED).

Free

|

0 events,

|

0 events,

|

0 events,

|

|

2 events,

–

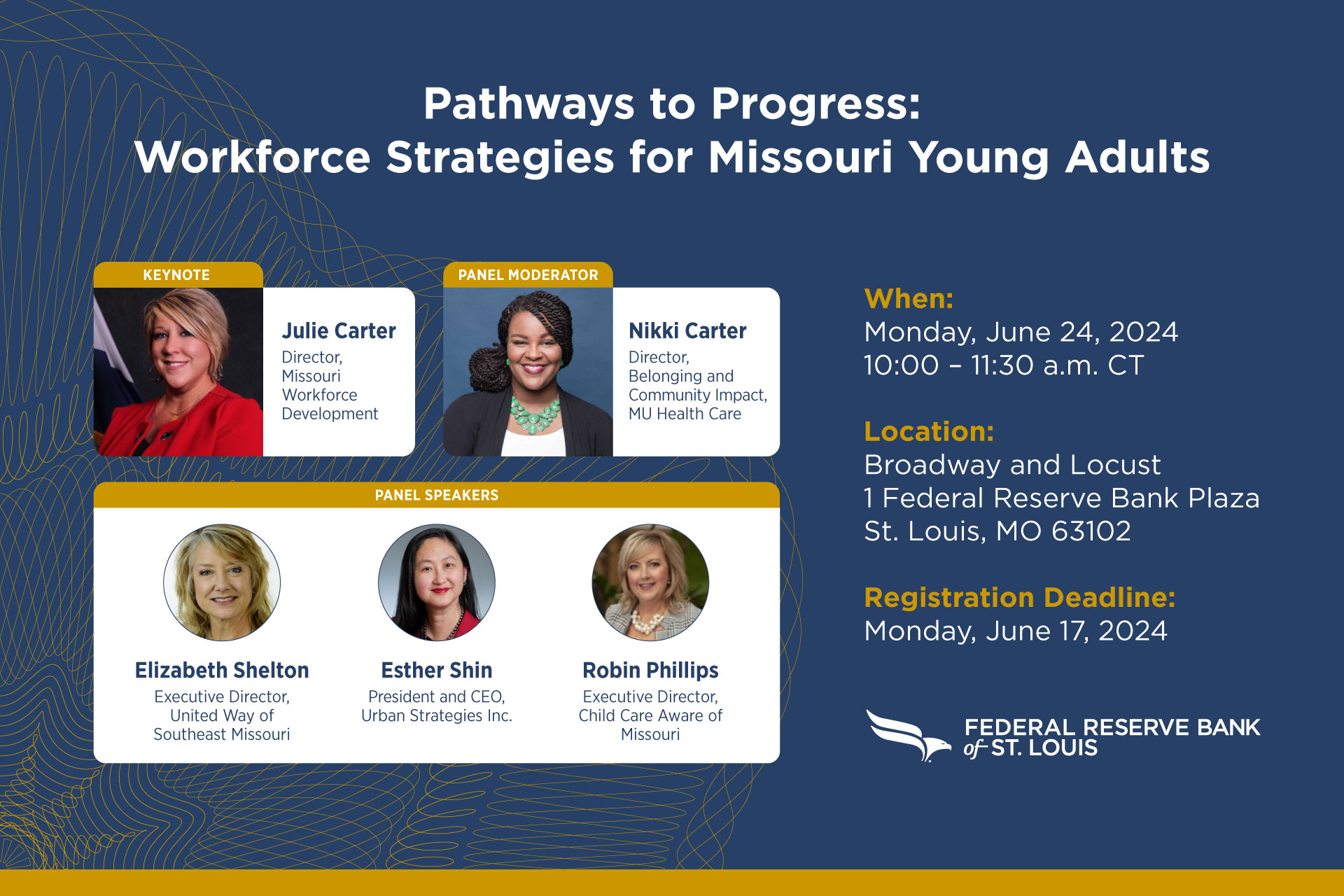

Join the St. Louis Fed’s Community Development department to discuss strategies for better connecting Missouri young adults to the workforce.

Free

–

The Federal Reserve Banks of Philadelphia and New York invite you to attend an in-person event on how communities in our region can harness opportunities and build the workforce needed to respond to climate risks. At this half-day event, attendees will hear directly from subject matter experts about the latest thought leadership on investing in workforce solutions for climate resilience. Attendees will also learn about adaptation and resiliency-related workforce solutions from contributing authors of the recent book, What’s Possible: Investing Now for Prosperous, Sustainable Neighborhoods.

Free

|

1 event,

–

Manufactured housing is often cited as a potential solution to two closely linked challenges in the U.S. housing market: inadequate supply and lack of affordable options for those looking to buy a home. Historically, the unusual way these homes have been treated from a financial and legal standpoint has diminished their potential, both for prospective homebuyers and for the 4.9 million existing owners of manufactured homes. Presenters will discuss recent efforts to improve the availability of safe and affordable financing, programs to address aging manufactured homes and community infrastructure, and opportunities to improve the residential security and wealth-building potential of manufactured homeownership.

Free

|

1 event,

–

Long-term care can be expensive. As society ages, thinking about how to pay for care if needed is becoming a priority for many of us. Join us for a FedTalk about long-term care insurance in the United States.

Free

|

0 events,

|

1 event,

–

The New York Fed, in partnership with the Rural Opportunity Institute and SVT Group, will host a hybrid event focused on case studies and strategies for tapping the economic potential of rural America. The event will feature rural innovators working to eradicate poverty in their communities. The public event will follow an invitation-only roundtable discussion on rural innovation and impact investing.

Free

|

0 events,

|

0 events,

|