Families across the country faced a range of financial difficulties in 2022 while managing the effects of inflation. Many people struggled to pay their bills or save for a rainy day as prices increased for basic needs. Those with retirement savings and other investments also saw their assets shrink as the stock market declined. Even as workers benefitted from a strong labor market, many felt that their earnings weren’t keeping up with rising costs.

Thousands of people shared these concerns, and others, with the Federal Reserve Board in the Survey of Household Economics and Decisionmaking (SHED). Each year since 2013, the SHED has collected national data on how families are faring financially. The most recent survey from October 2022 found substantial declines in several measures of financial well-being compared to a year earlier. For example, the share of people who said they were doing okay financially or living comfortably dropped 5 percentage points since 2021 to 73%, one of the lowest levels seen since 2016. A record share of people also said they were worse off financially than the year before.

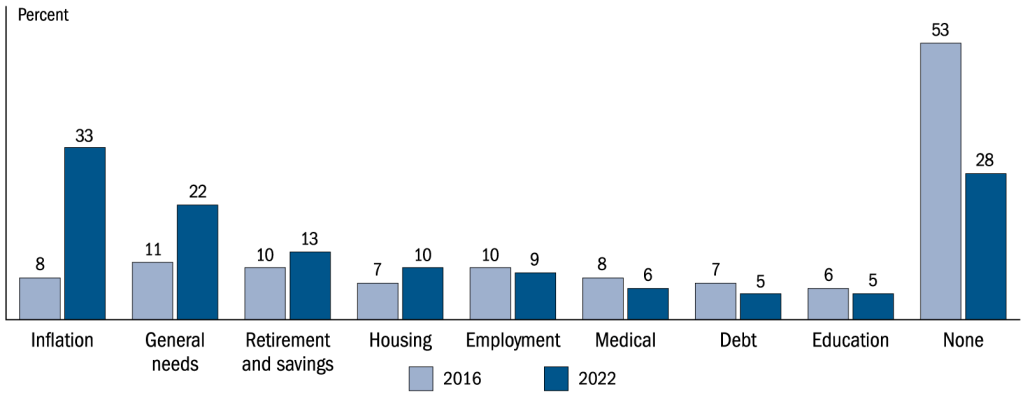

To understand these declines in financial well-being, the 2022 survey asked respondents to describe their main financial challenges in their own words for the first time since 2016. As described in the Economic Well-Being of U.S. Households in 2022 and shown in the figure below, inflation was the most commonly cited financial concern. This post explores these responses and the insights they provide into findings from the survey.

Figure

Categories of self-reported main financial challenges, 2016 and 2022

| Category | 2016 | 2022 |

|---|---|---|

| Inflation | 8 | 33 |

| General needs | 11 | 22 |

| Retirement and savings | 10 | 13 |

| Housing | 7 | 10 |

| Employment | 10 | 9 |

| Medical | 8 | 6 |

| Debt | 7 | 5 |

| Education | 6 | 5 |

| None | 53 | 28 |

Difficulties with inflation

Consistent with the elevated inflation rate at the time of the survey, many respondents said that inflation had squeezed their household finances. Rising prices for necessities such as groceries and utilities made day-to-day expenses more difficult for many families to cover. One respondent from New Jersey captured this common sentiment by explaining that “rising costs are really cutting into my budget.”

“Rising costs are really cutting into my budget. I have to be more careful with how I spend my money and where.”

33-year-old from New Jersey

“My electricity bill went up. Gas and groceries have gone up. I have to choose what to buy or pay every pay period.”

40-year-old from Texas

Challenges saving for the future

While inflation weighed on people’s short-term financial decisions, some also expressed difficulty saving for the future or for unexpected emergencies. The share of adults who had three months of emergency savings declined 5 percentage points from a year earlier (to 54%). The survey found a similar 5 percentage point decline since 2021 (to 63%) in the share who would pay for a $400 emergency expense with cash on hand, such as savings or a credit card paid off at the next statement. One respondent from Colorado said, “We had a generous cash reserve at the beginning of the year. It is gone now.” Another from Minnesota described how their rainy-day fund “is slowly being depleted.”

“Prices have gone up, a lot, on everything. We had a generous cash reserve at the beginning of the year. It is gone now.”

66-year-old from Colorado

“Our overall value is dropping. We have over the years developed a rainy-day fund for financial crises, but it is slowly being depleted.”

85-year-old from Minnesota

“Inflation has made it close to impossible to save for retirement or add to an emergency fund. Wages have not nearly kept up with inflation.”

40-year-old from Montana

Wages failing to keep up with expenses

Despite signs of a strong labor market — with more people asking for raises and switching jobs — some people said that their earnings weren’t increasing as fast as their expenses. Respondents were more likely to report increases in monthly spending than increases in monthly income. Many people expressed concerns about their earnings lagging behind inflation. One respondent from North Carolina said that prices “keep drastically increasing while my pay is not.”

“The cost of food and basic household necessities keep drastically increasing while my pay is not.”

40-year-old from North Carolina

“Rent and groceries prices have been raised, my jobs have been cut back and main work has not given a raise equal to what is needed to get by.”

51-year-old from Texas

“Everything is just too expensive – from housing to groceries to utilities/gas. Wages are not keeping up.”

43-year-old from Virginia

Shrinking retirement savings

Alongside widespread concerns about inflation, many people worried about their retirement savings. Compared to a year earlier, the share of non-retired adults who felt their retirement savings plan was on track fell 9 percentage points to 31%. When describing their main financial challenges, many people expressed concern about declines in their retirement savings. Frequently, these concerns related to shrinking asset values. For example, one 68-year-old from Missouri noted that “we’re on a fixed income and our investments are worth so much less.”

“Retirement funds have dropped considerably with the market drops; health care is unaffordable, meaning retirement will be delayed just to keep it.”

52-year-old from Nebraska

“My retirement fund is taking a beating. I’m worried that I may not have enough to retire. Trying to pay bills is a hassle.”

47-year-old from Georgia

“Losing a lot in 403(b) worries me since my retirement is coming soon.”

64-year-old from New Hampshire

“This bad economy has me scared because we’re on fixed income and our investments are worth so much less.”

68-year-old from Missouri

Barriers to homeownership

Some people also expressed difficulty saving for goals such as homeownership. Nearly two thirds of renters said they rent their home because they can’t afford a down payment for a home purchase. Some renters described saving for a down payment as their main financial concern, such as a 29-year-old from North Carolina who said that “housing purchase prices are increasing faster than I can save for a down payment.” Another 37-year-old from California similarly explained that “saving enough to buy a home while housing seems to continually be out of reach because of inflation.”

“Rent keeps increasing faster than pay, and housing purchase prices are increasing faster than I can save for a down payment.”

29-year-old from North Carolina

“Saving enough to buy a home while housing seems to continually be out of reach because of inflation, housing price increases faster than compensation.”

37-year-old from California

“We live in an area where it’s incredibly difficult to save up money to own your own home because rent is ridiculous.”

29-year-old from New York

Worries about general needs, even without inflation

Although inflation can worsen financial challenges, some adults — especially those with low incomes — struggle to meet their basic needs even when prices are stable. Reflecting this, some respondents simply described difficulties paying bills rather than expressing concern about rising prices. One low-income respondent from New Jersey asked, “Do I buy food or pay my bills?” For adults with tight budgets, financial challenges may be more persistent.

“I make $16.23 per hour. Do I buy food or pay my bills? Forget buying medicine!”

49-year-old from New Jersey

“Bills are higher than income. Have to use credit card a lot for groceries. Rent is extremely high and I’m a single parent and don’t get child support.”

33-year-old from Florida

“It’s been a very stressful time, not knowing if we are going to have enough to make it and pay for the bills and medications and food and mortgage.”

61-year-old from California

“Most of my paycheck is spent on rent! Any amount leftover has to be budgeted for gas and groceries to last until the next paycheck.”

23-year-old from Washington

Conclusion

Hearing people describe their financial concerns in their own words helps to provide deeper insight into the challenges driving trends in data about economic well-being. These responses reveal that inflation strained finances for families across the country. As rising prices outpaced income increases, many people expressed difficulty covering basic expenses and saving for goals such as retirement or a home purchase. Consistent with these concerns, the 2022 SHED captured quantifiable declines in overall well-being, emergency preparedness, and savings plans, among other indicators of families’ financial health.

To learn more about the SHED’s findings and for the full report, downloadable data, and other materials, visit the Federal Reserve Board of Governors.

![[Watch] Highlights from the 2024 Survey of Household Economics and Decisionmaking](https://fedcommunities.org/wp-content/uploads/2023/06/shed-connecting-communities-0713.png?w=1024)

![[Watch] The Economic Well-Being of U.S. Households in 2023](https://fedcommunities.org/wp-content/uploads/2024/04/1920-x-1280-CC-July-13.jpg?w=1024)