Homeownership is still a major way average families build wealth, and recent data show racial and ethnic homeownership gaps began to lessen slightly during the pandemic. Does this mean the racial wealth divide will shrink?

During the pandemic, homeownership rates rose, and some gaps shrank

In a November 2023 webinar capping a Federal Reserve series on housing, Jung Hyun Choi, Senior Research Associate at the Urban Institute’s Housing Finance Policy Center, shared homeownership data trends since 2019. These numbers reveal that US residents’ housing choices shifted somewhat during the pandemic.

Notably, the homeownership rate went up for white, Black, Latino, and Asian borrowers alike between 2019 and 2021. Homeownership gaps between Black and white households and between Latino and white households also slightly lessened in at least 40 states.

Researchers are still investigating the reasons for this growth in homeownership. Some speculate that as it became clear the pandemic would continue longer than initially expected, households with means made different housing choices in response.

Families sought more space to accommodate work and study at home needs, for example. Federal pandemic-related assistance payments also may have given some moderate-income families just enough additional money to be able to consider buying a home.

“People who may have been saving already for homeownership suddenly had the motivation and potentially a bit more in financial resources,” said Carolina Reid, Distinguished Professor and Faculty Research Advisor at UC Berkeley’s Terner Center for Housing Innovation.

It’s still difficult for lower-income renters to enter homeownership

Yet even as racial and ethnic homeownership gaps shrunk overall, some disparities grew. Since 2019, lower-income people appear to encounter greater difficulty entering homeownership. This is particularly true for lower-income people of color who hope to buy a home.

As Choi’s data show, the share of homebuyers decreased among borrowers with incomes below $75,000 per year:

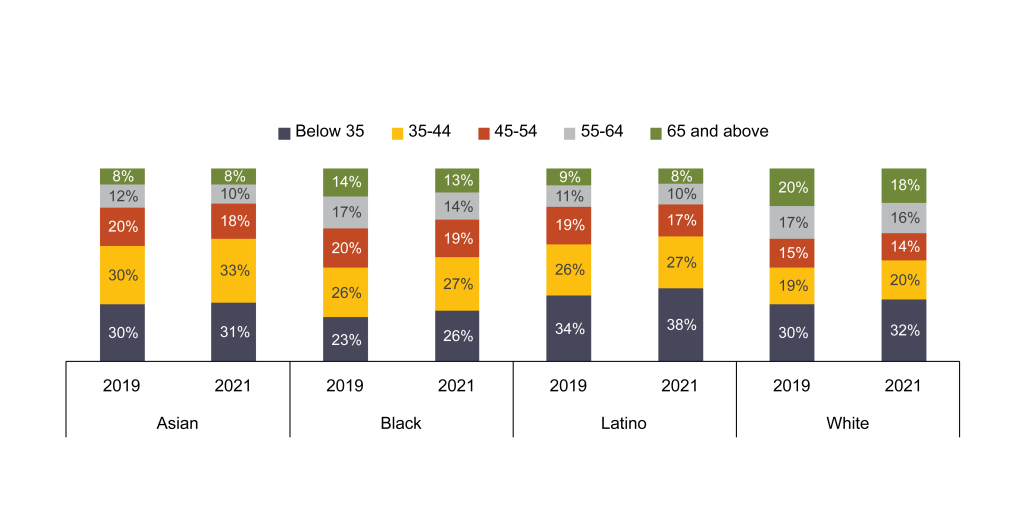

Share of younger homebuyers increased between 2019 and 2021, especially among Black and Latino households

By 2022, data show a notable drop in the number of mortgage loans used to purchase homes. A smaller share of mortgage borrowers had incomes under $50,000 per year. People were more likely to be declined for these loans because they had higher debt relative to their income. And more borrowers who did buy put more than 20% of the purchase price as a downpayment on their home.

Numbers like these suggest that households with lower incomes and higher debt may not be applying for home mortgage loans. Those who do apply appear to be less likely to be approved. People also may need more money available up front to buy a home in the current market.

“Some data suggests that if homes were more affordable during this period and credit was not as tight, we might have seen a greater increase in the Black and Latino homeownership rate,” said Choi. “More lower-income households could have benefited from the historically low interest rate.”

Renters—particularly renters of color—face constraints saving for down payments

High rents in many areas also make it even harder for renters to consider homeownership. Putting more of their income toward rental payments leaves renters with less to save toward a downpayment. They also have fewer financial resources to pay down any debts, such as student loans, and build their credit scores.

For many Black and Latino renters who want to become homeowners, the legacy of discrimination in US homeownership policies compounds this strain. Previous generations faced redlining and racially restrictive covenants when they tried to buy homes.

These policies held Black and Latino families back just as homeownership began to take off for white families. Barred from the opportunity to build wealth through homeownership, families of color had far less to pass along in turn to following generations.

“About thirty percent of white families report receiving inheritances or gifts, which they can use to help with a downpayment,” said Rocio Sanchez-Moyano, Senior Researcher at the San Francisco Fed. “It’s much lower in communities of color. Just 10 percent of Black families and seven percent of Hispanic families report receiving inheritances or gifts.”

She added, “The elephant in the room is that these deliberate policy decisions that were made many decades ago have perpetuating effects in the current moment.”

The importance of timing

Even for those who do manage to buy a home in the current market despite these limitations, timing is everything. For much of the last half of the 20th century, US home prices stayed fairly stable. Since 2000, prices rose and fell much more wildly. In this landscape, when a family buys a home can be just as important as whether they can buy at all. Buying at the wrong time can cost families future wealth.

The last two decades have been characterized by unprecedented house price volatility and growth

UC Berkeley’s Reid pointed out, for example, that research shows a large volume of Black and Latino households became homebuyers between 2004 and 2008, when they were more likely to have been offered a mortgage with risky, sometimes predatory terms. These are known as subprime mortgages. One in four of these buyers then lost their homes in the foreclosure crisis. The losses damaged their credit scores and household finances.

As prices fell in following years, these families were shut out of the ownership market. At the same time, Reid said, a much greater concentration of white households and investors bought homes at these lower prices. These buyers tended to have higher credit scores and more financial resources at hand.

“Right when it was most financially feasible and profitable to buy these homes, the people who had been most hurt by the subprime crisis and the spread of risky loans were the ones who were least able to take advantage,” Reid said.

Shrinking the homeownership gap may not shrink the wealth gap

Homeownership long has been considered a key opportunity for US families to build wealth. But price volatility may continue to threaten Black and Latino families’ ability to build wealth from homeownership.

As more Black and Latino families enter homeownership now, with prices and rates rising, Sanchez-Moyano said she worries their future wealth could be negatively impacted again. If this is the top of the market and prices fall from here, their homes may lose value. They may also pay more for their mortgage, given higher prices and rates.

“Homeownership remains a critical path towards wealth building in the US,” said Reid. “But homeownership is not necessarily a path to closing the wealth gap.”

Experts say approaches that broaden homeownership access and stability may help

Researchers suggest that some interventions might make a difference toward lessening the divides in both homeownership and wealth. Some point to programs that provide down payment assistance. There are also models that allow renters who may not qualify for a loan based on their credit scores to instead qualify based on evidence of on-time rental payments over several years.

Reid highlighted options she believes may have promise in building wealth for more families and empowering communities. These models include community land trusts and shared-equity housing. Both structures use shared forms of ownership or wealth building to keep homeownership more affordable. Reid also noted that a renters’ tax credit could help some families save toward buying a home and extend a benefit similar to the mortgage interest deduction to renters.

Without a change to make homeownership a more affordable and achievable goal for more people, experts say, the patterns noted above may continue to repeat themselves. That cycle can hinder further progress on the racial wealth gap.

“As we learned from the researchers in our webinar, there’s a stark racial wealth divide today in 2024,” said Sanchez-Moyano. “That gap could grow even bigger by 2040 if nothing is done to change current trends.”

Keys to Opportunity in the Housing Market

Want to dive deeper into this topic? Check out the webinar “Keys to Opportunity in the Housing Market: Renting, Owning, and Implications for the Racial Wealth Gap” to learn more about recent research and policy proposals around renting and homeownership equity in the United States.