Top image. Participants in the COFFEE Project build a composting system for an urban agriculture project in Jacksonville, Florida. The paid workforce development program for young adults from ages 16 to 24 teaches leadership, construction trade skills, and workforce preparedness.

Every Saturday morning as a young girl, Carrie Davis accompanied her mother to their local community bank. While her mother made deposits and paid bills, bank employees made sure Carrie had a cup of cold orange juice and a lollipop. “I’ll be 53 this year. I opened my first account at our local bank when I was 14. I still have that same account,” Davis said. “Because my mother had a relationship with the bank, I knew when I got my first paycheck, to go open a bank account there. I was lucky to have that embedded in me.”

Davis now runs Wealth Watchers Inc., a Jacksonville, Florida-based HUD-certified Housing Counseling and Community Development organization that helps low- and moderate-income (LMI) people learn the basics of finance, begin building wealth, and in some cases, become first-time homebuyers. These processes involve learning about services financial institutions offer and understanding the value of developing a relationship with a bank. “We want to provide a space where families are constantly talking about their financial goals. We’ll ask them to do field trips, like take the kids to the bank on a Saturday and introduce them,” explained Davis.

Her teaching and lending partners are banks across the region motivated by the Community Reinvestment Act (CRA). The CRA is a federal law that requires banks to invest in their local communities, including low- and moderate-income communities. Many banks meet their CRA commitments through partnerships with groups like Wealth Watchers that assist LMI people with wealth-building and home ownership.

Two decades of CRA partnerships

Davis has worked in the community development field for 20 years.

During that time, she’s noticed an increase in banks making investments in LMI communities. She attributes that to the standards set by the CRA. “Banks are more determined to pass their assessments and receive credit. Our lending partners have made huge financial commitments to increase minority homeownership. I’ve also noticed banks’ physical footprints expanding” in those neighborhoods, Davis said.

Davis has also seen partnerships among lenders and community nonprofits expand and become more creative to meet the needs of residents.

One of Wealth Watchers’ lending partners, BBVA, provides instructors for jointly-sponsored education workshops through its Center for Financial Education. These financial bootcamps teach basic financial concepts including the importance of savings, budgets, and interest. In-person instruction is augmented by online resources from other CRA partner institutions like TD Bank, which offers digital educational tools for children.

“I tell my staff, don’t build me anything you wouldn’t live in.”

– Carrie Davis, CEO, Wealth Watchers

Another CRA partner, Bank of America, offers affordable and accessible bank accounts through the Cities for Financial Empowerment Fund’s Bank On program.

Wealth Watchers also works with banks, as well as city and county programs, to provide prospective homebuyers with down payment assistance, including Own a Home Grants that provide successful applicants an average subsidy of $7,500 if they complete Wealth Watchers homebuyer education workshops.

Wealth Watchers itself offers applicants up to $3,500 in assistance for down-payment loans. Initially funded by Wells Fargo through Let’s Invest for Tomorrow–a NeighborWorks America down payment assistance program–the Wealth Watchers fund is now self-sustaining via repayments from earlier aid recipients.

Since 2001, Wealth Watchers has helped 126 families reach their goal of homeownership, aided 65 families in keeping their homes, and provided counseling and education to 658 families. “Communities are about people, places, and things,” said Davis, “but the people are the most important. That’s what we need to be investing in.”

“I love every corner of my home“

One of the people Wealth Watchers invested in is Vicenta Greene.

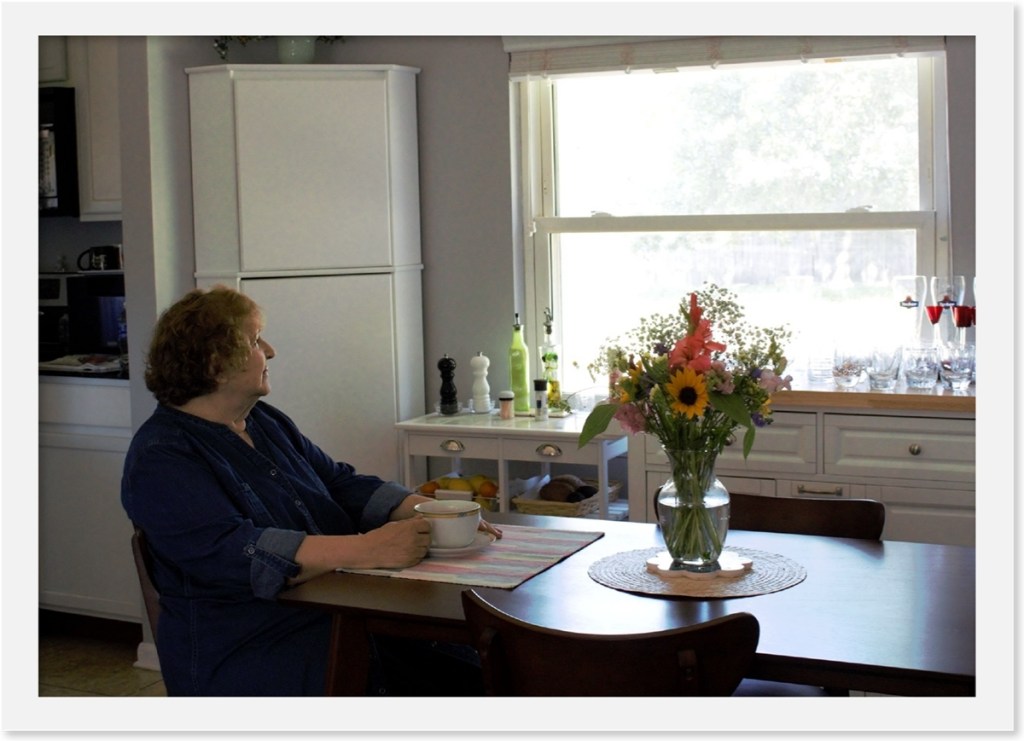

After more than a year of house hunting during the coronavirus pandemic, Greene closed on a single-family home, nestled in a cozy cul-de-sac of Jacksonville. Greene, the widow of an Air Force veteran who passed in 2019, enjoys her new neighbors, many of them retired veterans themselves. “They made me feel welcome immediately,” said Greene.

“We all have each other’s phone numbers to check up on one another.”

In 2019, Ms. Greene began her journey to homeownership by applying for financing to four banks. She was turned down by all four because she was unable to meet their credit standards.

One lender suggested she try Wealth Watchers to see if she could get help pulling together her finances. With its CRA partnerships and funding from multiple banks, Wealth Watchers was well positioned to help aspiring homeowners like Greene.

From the beginning, Greene said, the staff at Wealth Watchers were friendly, informative, and supportive, boosting her confidence.

Her first step with the organization was enrollment in its Homebuyer 101 Orientation program, a course that outlined the homebuying process and discussed the importance of credit.

In the next step, Greene was paired with a financial counselor from Wealth Watchers to create a homebuying plan specific to her credit history and budget.

Before beginning to look for a home, Greene also had to attend eight hours of homebuyer workshops. These online classes walked her through steps she needed to build up a bankable credit history, discussed down payment programs and different types of mortgage products, and the information and documents needed for the mortgage application process.

During these workshops Greene met other potential homebuyers, with whom she traded stories of the ups and downs of the preparation process and shared moral support.

“My experience was quite different this time around. I was well equipped with an array of information, thanks to the wonderful and numerous workshops from Wealth Watchers, and personal attention and guidance from my financial counselor,” Greene said.

Additional support came from Monique Terry, Wealth Watchers’ vice president of Community Development, who guided Greene through the workshops, made herself available to answer questions after hours, connected Greene to an experienced real estate agent, and helped her find new prospective lenders when early financing efforts fell through.

Terry was “a guardian angel” who provided constant encouragement to keep going and not give up on her homebuying quest. “She never made me feel like my questions were unnecessary or that I was a burden,” said Greene.

“On the contrary, she encouraged me to question everything, so that I would be confident with my decision.”

Greene recently sat sipping coffee in her kitchen and smiled as she offered an assessment of that decision: “I love every corner of my new home.”