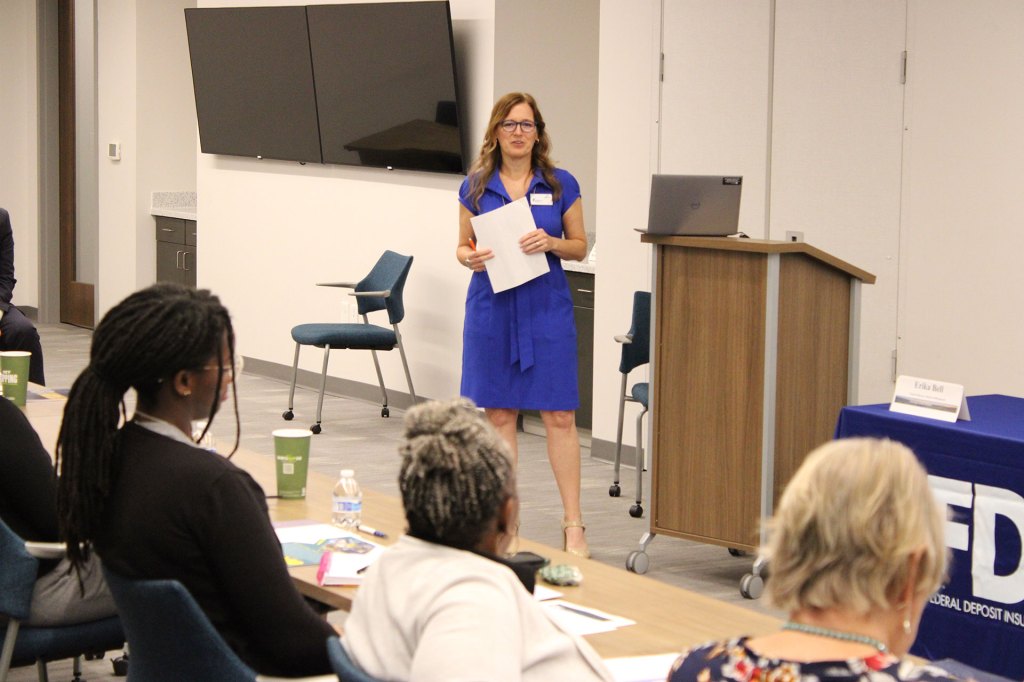

Maria Thompson, f. Outreach Manager, Federal Reserve Small Business Credit Survey

Maria Thompson knows small business, both personally and professionally. As the former national outreach manager for the Federal Reserve Small Business Credit Survey (SBCS), Maria taps her expertise and personal experiences to advocate tirelessly for small firms.

“Small business has long been an interest of mine,” Maria says. She’s been a Community Reinvestment Act officer for a commercial bank and held leadership positions with nonprofit organizations. She’s also owned a small business. Maria’s knowledge and passion to help small businesses succeed align perfectly with her outreach role with the SBCS.

Conducted annually by the Fed each fall, the SBCS provides timely information about small businesses’ credit conditions to policymakers, service providers, and lenders. Maria works year-round building and managing partner relationships that the Fed’s SBCS team has established with national and regional service organizations. These partner organizations ask their members to take the survey each year, contributing to the overall responses for the SBCS. In return, the partner organizations receive data specific to the credit health of the firms they support. Maria’s colleagues analyze the responses collected from small business owners across the nation and publish reports on the experiences of specific subgroups, such as employer firms, minority-owned firms, LGBTQ-owned firms, and more. Maria uses these reports to inform and recruit additional partner organizations.

“Partnerships can make credit more accessible and, in turn, small businesses—and the families and communities they support—more successful.”

Early influence spark a passion for community service and small business

Maria’s twin interests in community service and business began in her childhood. Her mother was involved in volunteer work in the community and owned a small business. After Maria’s father’s untimely death, her mother, a teacher, invested $2,000 in an IBM Memory Typewriter—cutting-edge technology at the time—and offered editing and typing services for businesses and college students.

“Life didn’t come easy for her,” Maria reflected. “Back in those days, there were a lot of challenges, especially for a single parent and a woman of color. She raised five children successfully on her own and with great faith, love, and joy.”

Maria gets her persistence and strong work ethic from her mother. But the career Maria built for herself is due to her own hard work and passion.

Maria earned an undergraduate degree in business administration, and later a graduate degree in community development and management from Case Western Reserve University. While her education and experience have propelled her career, Maria’s love for people and community have helped her continue on a career path where she feels she can provide service to the community.

Maria was awarded the inaugural Louis Stokes Community Leadership Award. She is pictured with Grover Cleveland Gilmore, who was Dean of the Mandel School at CWRU at the time.

A bank-community partnership Maria worked on was runner-up out of over 12,000 national bank/city partner collaboration submissions for the prestigious Social Compact Award from University Settlement. The project was designed to be a beacon for low- and moderate-income families with five or more family members, which were/are often harder to assist and stabilize because of their larger family size. Maria is pictured center with University Settlement’s executive director, Social Compact’s board chair, and University settlement’s board chair (from left to right).

Making connections: past, present, and future

Maria’s excitement for leading the SBCS’s national outreach stems from the struggles she’s observed of small businesses. Her own experiences and what she’s learned by helping other small business owners give Maria a deeper understanding of the obstacles they face. Access to credit is one challenge that can make it difficult for businesses to succeed or grow, especially during a pandemic. And that challenge, Maria notes, can be an extra tall hurdle for minority business owners, who are often less likely to apply for credit because they don’t think they will be approved.

“Discouragement is a real barrier to credit access for minority-owned businesses,” she said. “It comes from a history of discrimination, which is often the reason why these entrepreneurs don’t feel a connection to lenders.”

It’s a good thing, then, that making connections is something that Maria excels at. She meets regularly with trade groups and others to share the SBCS findings and explain how better relationships help both the lenders and the small businesses. She also writes blogs, seeks opportunities to educate the public, and looks for other ways to bring attention to the issue of small business credit. Maria has also proposed creating an advisory council for the SBCS to help reach even more small business owners.

“These partnerships can make credit more accessible and, in turn, small businesses—and the families and communities they support—more successful,” said Maria.

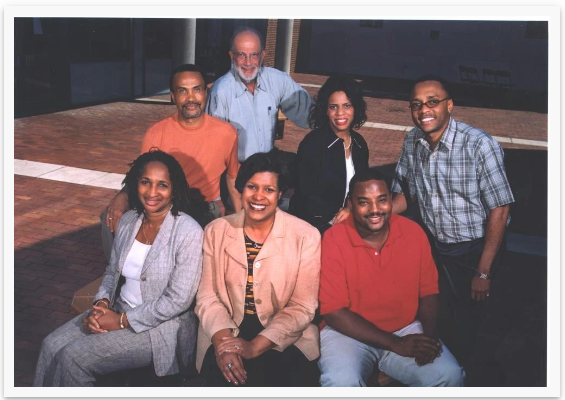

Maria received her Master’s Degree in community development & management from Case Western Reserve University as a Congressman Louis Stokes Fellow. Here she sits with her cohort, selected from across the country for the national merit scholarship. At the time, Maria lived in Atlanta and commuted to Cleveland for the intensive weekend graduate program.

Interested in learning more about the Federal Reserve Small Business Credit Survey? Read the latest reports at fedsmallbusiness.org.

Editor’s note: Maria Thompson left her position with the Federal Reserve Small Business Credit Survey in September 2023.