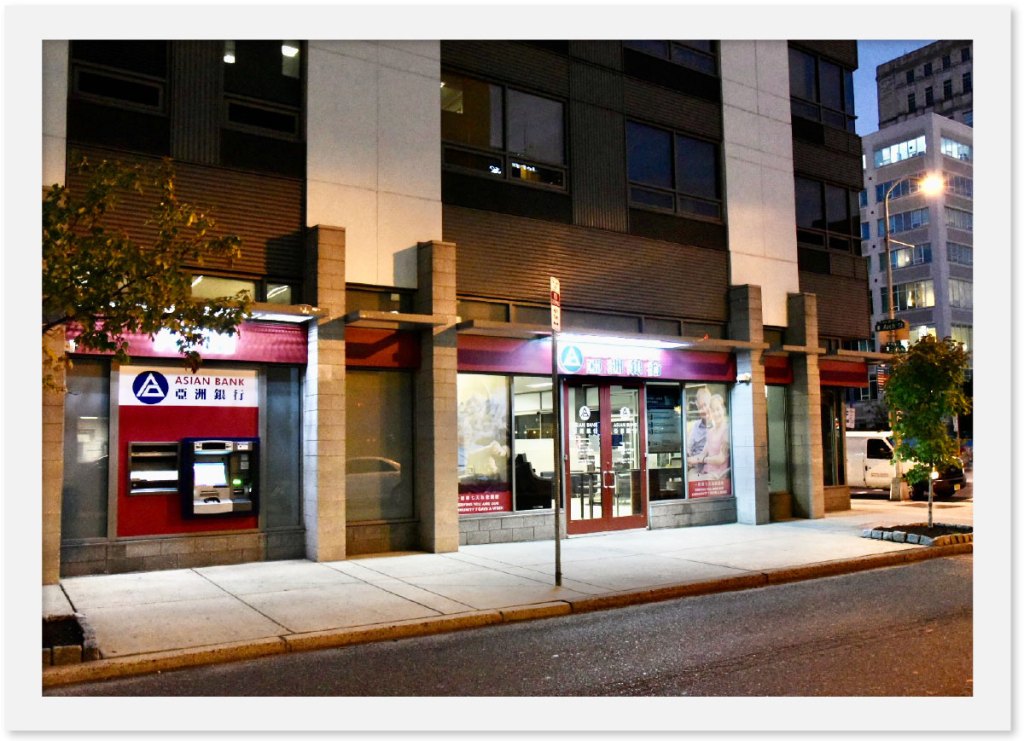

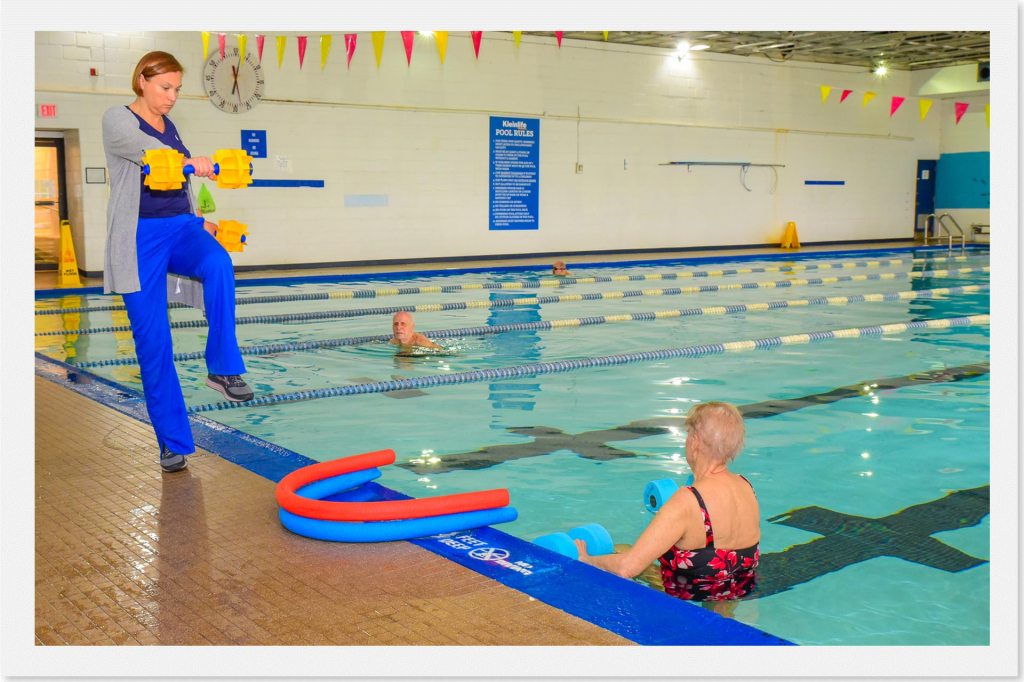

Top image. Seniors swim and receive physical therapy in the pool at Eastern Approach Rehabilitation Aquatic Center of Chinatown in Philadelphia, PA. The center is just one of several businesses that a local Community Development Financial Institution helped through the pandemic.

In 2020, the COVID-19 pandemic forced co-founders Joseph Wang and Leonard Stavropolskiy to consolidate office hours and reduce staff. They’d lost more than 50 percent of their business revenue. “We were devastated when the pandemic hit. Nobody knew what to do,” said Wang.

For nearly two decades, Wang and Stavropolskiy had successfully operated a pair of holistic healing centers in Philadelphia’s Chinatown community. The two centers, Aquatic Therapy of Chinatown and Eastern Approach Rehabilitation Center, offer services ranging from physical therapy to nutritional counseling.

The two reached out to their primary bank in search of emergency funds. “Nobody would call us back,” Wang said, describing his frustration when seeking assistance at the onset of the pandemic. While asking around, Wang learned many of his friends with small businesses were having similar problems. Larger financial institutions were not returning their calls. One friend suggested he try a local bank.

“We were lucky to have them. They saved us. They saved a lot of us.”

Joseph Wang, Aquatic Therapy of Chinatown | Eastern Approach Rehabilitation

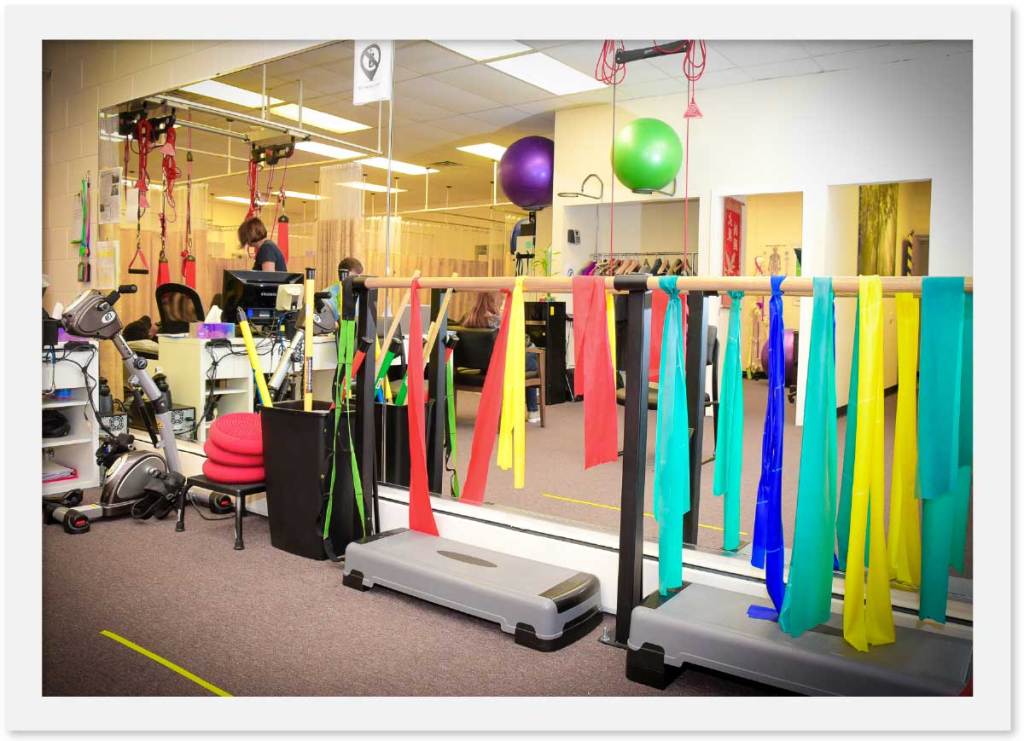

Calling on the local small bank

Wang decided to call a small bank known for working with the community, Asian Bank, located five minutes from the Aquatic Therapy office. A lending officer at Asian Bank answered all of Wang’s and Stavropolskiy’s questions about possible aid options. The two decided to apply for help from the Paycheck Protection Program (PPP).

Asian Bank guided the two men through every step of their application for a loan to help keep their businesses afloat. Their application was approved. Over the next several months Wang noticed that Asian Bank helped his friends with small businesses in similar ways. “We were lucky to have them. They saved us. They saved a lot of us,” he said.

Asian Bank disbursed more than 300 PPP loans from early April 2020 when the program began until May 31, 2021, when the program ended. A majority were to small businesses in its community, with a median loan amount of about $20,000.

Today, Aquatic Therapy and Eastern Approach have an ongoing business relationship with Asian Bank. Wang credits this relationship to the financial assistance Asian Bank rendered to him and his business partner in a crisis. “People are not just a number,” said Wang. “Treat people like family. That’s how you build a community.”

We are proud to be a resource

“Our motto isn’t to focus on a specific segment of the community because we deem them the most profitable. Our motto is, how can we help the people in our community. Period,” explained James Wang, CEO of Asian Bank. (James Wang is unrelated to Joseph Wang.) “If we do our job right as a community bank and a minority depository institution (MDI), then we’ll see our community grow and thrive as a result,” he said.

Asian Bank’s interest in bolstering local businesses like Aquatic Therapy and Eastern Approach is the reason the bank meets its Community Reinvestment Act (CRA) commitments. The CRA is a federal law that requires banks to invest in the areas they serve, including low- and moderate-income communities.

Headquartered in the heart of Philadelphia’s Chinatown, Asian Bank prides itself on tailoring services to fit the needs its customers. Many are migrants from across East Asia and Southeast Asia.

Tellers and other front-line staff speak at least one other language in addition to English. Customers can transact business in native tongues that include a variety of Chinese dialects, as well as Indonesian.

“The community has placed their trust in us, and that’s a valuable thing to have.”

James Wang, Asian Bank

Staff often serve as translators for area residents and at times provide help understanding paperwork and processes outside of banking. “The community sees us as a resource. Our employees and I are proud to be that. The community has placed their trust in us, and that’s a valuable thing to have,” said Wang.

Community outreach to residents, other lenders

James Wang traces Asian Bank’s strong CRA track record to partnerships with local organizations and other community involvement. “As a bank, we are aware of the regulation and want to make sure we comply. I think a lot of what CRA requires [is also something] we just kind of do as a part of our business model,” he said.

The MDI encourages its employees to volunteer their time with non-profits through board service and by teaching financial literacy classes. James Wang himself sets the tone. He serves on the finance committee of the Folk-Arts Cultural Treasures (FACTS) Charter School, a K-8 Chinatown elementary school, and his bank supports the school with grants to purchase supplies. Additionally, Wang is on the board of On Lok House, a social service agency. It aids low-income seniors in Chinatown, and Wang often volunteers serving meals among other activities.

Some of his employees give presentations to teenagers about the importance of developing banking relationships. The teens are affiliated with Asian Americans United (AAU), a local advocacy group.

Asian Bank also has partnered with the Greater Philadelphia Chamber of Commerce to create a program for small businesses. It will ensure the owners of newly-started businesses have sufficient working capital to sustain them through their first three to five years.

For all of its community engagement, there are limits to what Asian Bank can do by itself. Loan demand in the community outstrips bank resources. Wang said Asian Bank is open to investment from or partnerships with larger financial institutions.

As both an MDI and a community development financial institution, Asian Bank is uniquely suited to help potential partners seeking to bolster their CRA track records.

Commitments involving multiple lenders make business sense and would deliver benefits to customers, Wang believes. “You should see [Asian Bank’s] success reflected in how well the community is doing.”