“TulsaWorks is as old as my child. I was pregnant with TulsaWorks and my son, Justin, at the same time, and I don’t take that lightly,” Sabrina Ware said. “I’ve poured my heart and soul into this organization.”

Ware serves as the director of Goodwill TulsaWorks Career Academy. The workforce development program provides job training, industry-recognized skills certificates, job placement services, and financial literacy education to residents in dozens of communities—many of them low- and moderate-income (LMI)—across two dozen counties in northeastern Oklahoma and southwest Missouri.

TulsaWorks started as a successful collaborative pilot project involving five separate agencies. Ware took the helm of the program when Goodwill assumed responsibility for it in the mid-1990s. Since 2018, TulsaWorks has provided job training to 3,317 people, hosted 2,013 hiring events and job fairs, and assisted 1,927 people in finding employment.

Ware attributes TulsaWorks’ staying power to the relationships it has built with other organizations, especially banks across the region. Many of these banks are motivated by the Community Reinvestment Act (CRA), a federal law that requires banks to invest in their local service areas, including LMI communities. As Ware puts it, “We were able to rely on our banking partners” to collaborate on programming that has made TulsaWorks “a model for the city on providing residents what they need at the time they need it and serving people with dignity.”

TulsaWorks has been expanding services to more clients through the Tulsa Financial Empowerment Center, which offers free financial counseling to residents regardless of income, and the IRS Volunteer Income Tax Assistance Program (VITA), a local tax preparation program that is free of charge for households earning $57,000 or less.

“TulsaWorks has been the springboard, the foundation for other programs to stand on,” said Ware. “We have been able to stand the test of time by tailoring our resources to the community’s needs. And we’re going to continue to do it that way as long as we can.”

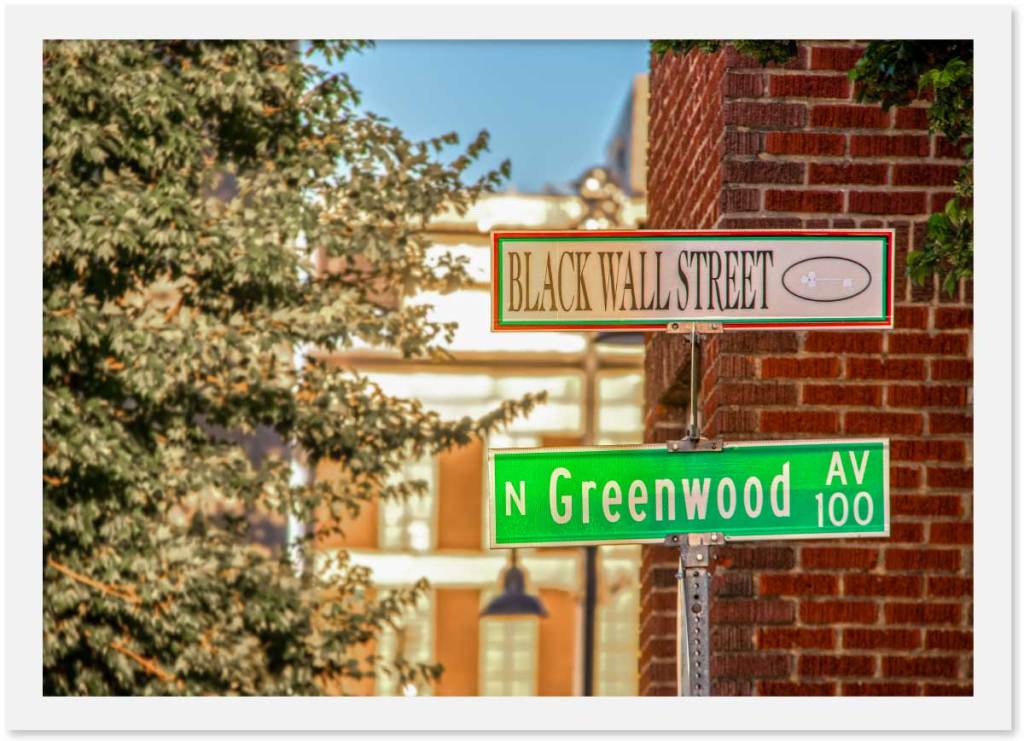

There is, Ware said, a special significance in working to support LMI wealth-building efforts in a city that was the scene of one of the most notorious episodes of racial violence in US history, the 1921 Tulsa Race Massacre. Hundreds of residents of Greenwood, a vibrant Black neighborhood, were killed by a white mob and more than a thousand homes and businesses were set ablaze and destroyed.

“We’re a stone’s throw away from the Greenwood district, less than five miles,” Ware said. “What happened a hundred years ago is one of the reasons why we exist. Every day we think about how we can support a future that is equitable and successful for all of Tulsa. We want to ensure we are lifting people out of their situations.”

Partnering on CRA commitments

To encourage wealth-building, TulsaWorks and its partners—including such financial institutions as Central Bank of Oklahoma, Security Bank, Arvest Bank, and local manufacturer AAON Inc.—prepare clients on how to get a job, how to keep a job, and how to manage money.

Ware’s group offers job preparation workshops to local high school students and connects them to an on-the-job safety program offered by Tulsa Community College. Upon completing both courses, students are eligible for paid internships at AAON.

Central Bank waives fees for all types of students in the TulsaWorks program and allows them to open accounts for direct deposit of their internship earnings. “For many of these 17- and 18-year-olds, [handling earnings from their internship] is their introduction to banking, and their first time opening personal bank accounts,” said Ware.

TulsaWorks was introduced to Security Bank through Investment Connection, a program launched in 2011 by the Kansas City Fed that helps banks fulfill their CRA responsibilities to provide funding to, and extend credit in, LMI communities. Security Bank employees began teaching financial education classes for TulsaWorks’ adult clients. Later, the bank helped develop and fund the Savings Match program.

In the Savings Match program, clients who complete job training and obtain employment are eligible to receive $125-per-quarter matches for bank savings in their first year of participation. Clients must verify their own savings with monthly deposit statements and can also sign up for virtual or in-person financial education sessions.

The financial contributions and education programs enable TulsaWorks to maintain a relationship with clients, allowing the agency to track job retention and address ill-matched job placements over the course of the year.

Another bonus? The education component of the program has filled a void created by local consumer credit counseling services’ having closed locations and moved their programming and services online. The shift was a problem for residents who didn’t have access to computers, broadband, or both.

“That left a huge gap, and it’s taken a while to rebuild that capacity,” said Parrish McDaris, a TulsaWorks Career Academy administrator. “We would have been unsure how we were going to get it done if [Security Bank’s] CRA dollars didn’t fund the Savings Match program.”

People connecting people

Adam Erby met the TulsaWorks Academy team about 5 years ago as a member of Arvest Bank’s CRA outreach committee. While working as a consumer and commercial mortgage lender, Erby began volunteering to make financial education presentations to community groups and social service organizations across Tulsa, including TulsaWorks Career Academy.

Erby’s first appearance at a TulsaWorks event was a lunch-and-learn-style presentation about how to open checking and savings accounts. “I’d previously sat through a PowerPoint presentation and thought, ‘Man, this is really boring. I hope I don’t have to do that.’” Erby went a more direct route with clients, telling them, “I’ve been in banking for eight years. Ask me questions. What do you want to know?” His presentation was a hit.

The best part about being on the TulsaWorks team is having the freedom to serve people in ways that meet their needs. We listen, we hear them. And that’s how we build our programs.

Adam Erby, Career Navigator for TulsaWorks’ security guard training program

So much so that TulsaWorks asked Erby back to conduct mock interviews for the agency’s job preparedness training, a service he performed regularly over the next two years.

In 2019, Erby’s department at Arvest began downsizing, prompting him to consider, “What do I want to do? What do I really enjoy doing?” His volunteer work with TulsaWorks was at the top of that list. He applied for a position and was called back the same day to join the team.

Today, Erby is the Career Navigator for TulsaWorks’ security guard program, where he helps clients become licensed security guards through unarmed guard training. With the program’s offering certification credentials, students are able to get jobs that pay almost double the minimum wage immediately after completing the program. As a Career Navigator, Erby provides support from enrollment to a year after graduation by connecting clients with food benefits, transportation resources, and helping find new employment options if the initial job were to not pan out.

“The best part about being on the TulsaWorks team is having the freedom to serve people in ways that meet their needs,” explained Erby. “We relate well with our clients. We listen, we hear them. And that’s how we build our programs.”

A foundation for success

One of the students TulsaWorks served was Anita Dwomoh, who moved to Tulsa in 2018 from Ghana, in West Africa.

After a couple of months settling into her new home, she needed to find a job to supplement the household income. Unfamiliar with the city, Dwomoh did not know where to look for work and struggled to pull together a resume. One of her friends suggested that she try getting help from TulsaWorks.

Dwomoh enrolled in the agency’s Digital Readiness Training and job interview preparation classes, which met for two hours a day, Monday through Friday, for four weeks.

Digital Readiness Training taught her strategies to use when searching for job leads on the internet and how to network in a virtual environment.

The job interview prep sessions included mock interviews where she learned how to answer questions, how to dress and conduct herself, and how to follow up with interviewers.

“I was sad when the classes ended,” Dwomoh said. Teachers were “phenomenal” and went beyond the content of the curriculum.

Dwomoh used the tools provided to her by TulsaWorks and its partners to land a customer service representative position at Arvest Bank in August 2019. She still works there today.

Like many TulsaWorks job training alumni, she participated in the Savings Match program. “It helped me build savings habits I still use today,” she said.

“If I had a chance, I would go back and help out,” Dwomoh said. “TulsaWorks gave me a good foundation to be successful.”